-

Feed de Notícias

- EXPLORAR

-

Páginas

-

Grupos

-

Eventos

-

Blogs

-

Marketplace

-

Fóruns

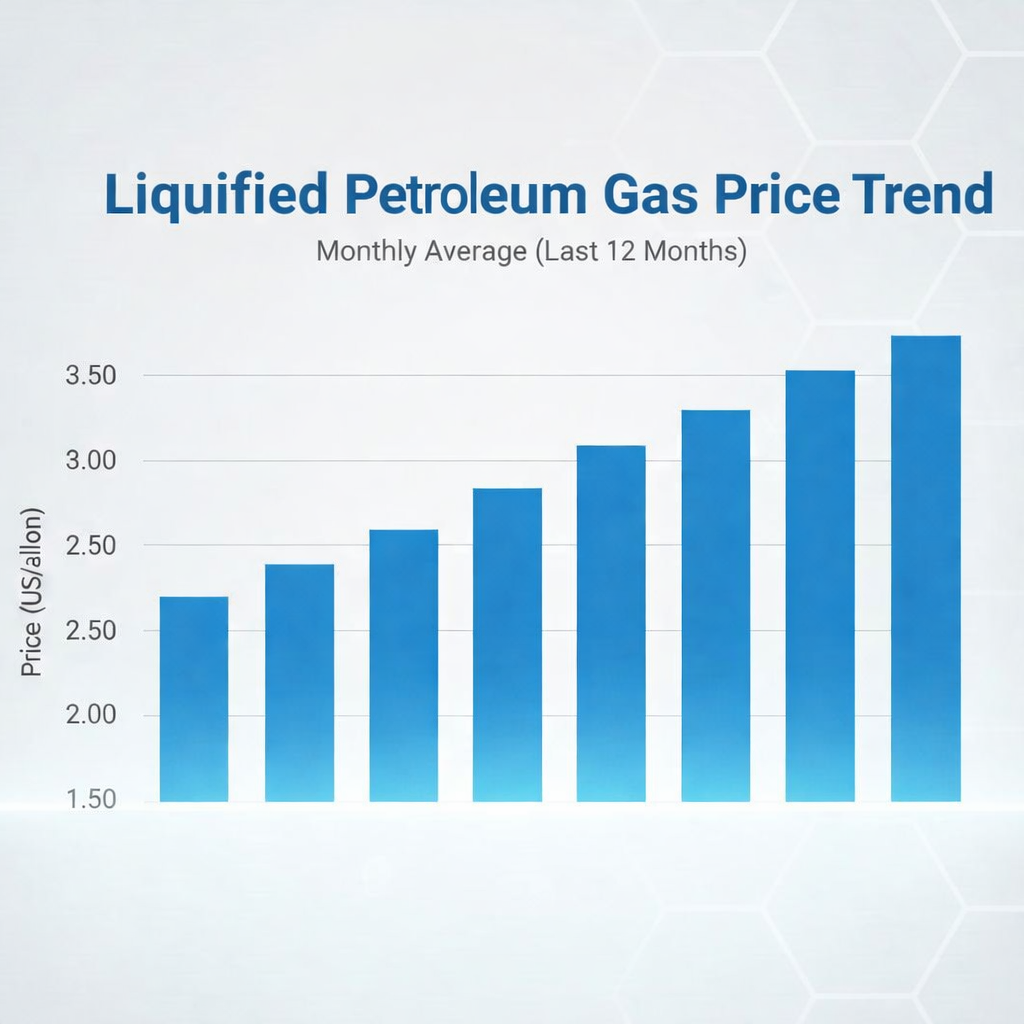

Liquified Petroleum Gas Price Trend: A Simple Look at Global Market Movements in Q3 2025

The Liquified Petroleum Gas Price Trend in Q3 2025 showed a clear downward movement across most major global markets. Unlike periods of sharp volatility or sudden price spikes, this quarter was marked by steady weakness, cautious buying behavior, and plenty of available supply. For businesses, traders, and end users, the market felt slow and competitive rather than urgent or tight.

Liquified Petroleum Gas, commonly known as LPG, is widely used across households, industries, and transportation sectors. Because of its everyday importance, even small price changes can influence costs for cooking fuel, industrial heating, and petrochemical production. In Q3 2025, prices softened not because of one single issue, but due to a combination of demand slowdown, comfortable inventories, and strong competition among exporters.

Global Overview: Why LPG Prices Fell in Q3 2025

At a global level, the Liquified Petroleum Gas Prices remained bearish throughout the quarter. Many importing countries already had enough stock, which reduced the urgency to buy fresh cargoes. At the same time, exporters in the Middle East and the United States continued producing at stable levels, creating a supply-heavy environment.

Asian demand, which usually supports LPG prices, was weaker than expected. Large consumers like China and India adopted cautious buying strategies. Instead of placing aggressive orders, buyers preferred short-term or spot purchases, waiting for even better price opportunities. This approach kept sellers under pressure to reduce offers.

Please Submit Your Query for Liquified Petroleum Gas Price Trend, Market Analysis and Forecast: https://www.price-watch.ai/book-a-demo/

Freight rates remained mostly stable during the quarter. While this helped exporters move volumes, it also meant that lower shipping costs did not create price support. Overall, the market leaned in favor of buyers, and sellers had limited pricing power.

Middle East Market: Competitive Pressure Builds

The Middle East plays a major role in shaping the Liquified Petroleum Gas Price Trend, as countries in this region are among the world’s largest LPG exporters. In Q3 2025, producers like Qatar, Saudi Arabia, and the United Arab Emirates faced a challenging export environment.

Regional competition increased significantly. Multiple Gulf producers offered similar cargoes to the same buyers, often at discounted prices. With demand not growing fast enough to absorb all the supply, exporters had to adjust prices downward to remain competitive.

Qatar LPG Price Trend: Gradual Decline with a Small Rebound

In Qatar, the Liquified Petroleum Gas Price Trend showed a noticeable decline during Q3 2025. FOB Hamad propane prices fell by around 7.59% over the quarter, with offers generally ranging between USD 513 and USD 586 per metric ton.

The main reason for this decline was weaker demand from Asia, combined with rising availability from neighboring Gulf suppliers. Buyers had more choices and were in no rush to commit, which forced Qatari exporters to reduce offers.

However, towards the end of the quarter, the market showed a slight improvement. In September 2025, prices rose by about 1.50%. This small rebound came as exporters adjusted pricing strategies to stimulate buying interest. While enquiries improved slightly, they remained moderate, and forward bookings slowed down.

Production in Qatar stayed steady throughout the quarter, and freight rates remained supportive. Still, sellers faced margin pressure as discounted cargoes became common in the Gulf region.

Saudi Arabia LPG Price Trend: Sharper Decline and Flat September

Saudi Arabia experienced an even sharper price drop during Q3 2025. The Liquified Petroleum Gas Price Trend here reflected an 11.51% decline, with FOB Jeddah propane prices ranging between USD 485 and USD 586 per metric ton.

Oversupply was a key issue. With global demand under pressure and multiple exporters chasing limited buyers, Saudi exporters had to cut prices aggressively. Even with these reductions, buyer interest remained weak for much of the quarter.

In September 2025, prices remained unchanged, showing zero monthly movement. This stability came after earlier price cuts had already adjusted the market to a lower level. Exporters tried to attract buyers by offering competitive deals, but forward bookings continued to slow.

Production levels stayed stable, and exports continued, but profit margins tightened as competition intensified across the Gulf.

United Arab Emirates: Similar Market Conditions

The United Arab Emirates followed a similar pattern in the Liquified Petroleum Gas Price Trend during Q3 2025. FOB Jebel Ali propane prices faced downward pressure due to regional oversupply and limited international demand growth.

Like other Gulf exporters, UAE suppliers operated in a crowded market where buyers held strong negotiating power. While exports continued smoothly, pricing flexibility became essential to maintain volumes.

Asia Market: Cautious Buying from Major Consumers

Asia plays a critical role in shaping the Liquified Petroleum Gas Price Trend, and in Q3 2025, the region contributed to the global price decline.

India and China, two of the largest LPG consumers, reduced aggressive buying. Both countries had sufficient inventory levels and focused on careful procurement strategies. Instead of building large stocks, buyers waited for favorable pricing opportunities, which reduced immediate demand.

As a result, CIF prices in Asia declined steadily. Sellers targeting Asian markets had to align offers with falling price expectations, reinforcing the bearish trend.

Europe and Latin America: High Inventories Weigh on Prices

In Europe, countries like Belgium and France also experienced weaker LPG prices. High inventory levels reduced the need for fresh imports, and competitive U.S. cargoes added further pressure.

Latin American markets, including Brazil, followed the same trend. Adequate supply and aggressive pricing from exporters kept CIF prices under pressure. Buyers across these regions remained cautious, preferring to delay purchases whenever possible.

United States: Oversupply Drives Price Decline

The United States contributed strongly to the global Liquified Petroleum Gas Price Trend downturn. FOB Texas prices fell significantly due to excess domestic supply and reduced export enquiries.

High production levels, combined with limited overseas demand growth, created an imbalance. U.S. suppliers were forced to lower prices to stay competitive in international markets, especially against Middle Eastern exporters.

Market Sentiment and Outlook

Overall, the Liquified Petroleum Gas Price Trend in Q3 2025 reflected a market dominated by oversupply, cautious demand, and strong competition. Sellers focused on volume rather than margins, while buyers enjoyed flexible sourcing options and favorable pricing.

Looking ahead, the market will depend on demand recovery, especially from Asia. Any rise in industrial activity or seasonal consumption could help stabilize prices. However, if supply remains high and buyers continue cautious strategies, price recovery may remain limited.

Conclusion

In simple terms, Q3 2025 was a tough quarter for LPG sellers and a comfortable one for buyers. The Liquified Petroleum Gas Price Trend stayed bearish across regions, shaped by weak demand growth, high inventories, and intense competition among exporters. While small rebounds appeared toward the end of the quarter, the overall market tone remained cautious and price-sensitive.

About Price Watch™ AI

Price-Watch AI is an India-based, independent raw material price reporting agency that provides real-time price forecasts and data-driven insights into global raw material markets. Price-Watch AI specializes in tracking raw material prices, analyzing market trends, and delivering timely updates on plant shutdowns, supply disruptions, capacity expansions, and demand-supply dynamics. The Price-Watch AI platform empowers manufacturers, traders, and procurement professionals to make faster, smarter decisions. Leveraging AI-powered forecasting and over a decade of historical data, Price-Watch AI transforms market volatility into actionable opportunity.

Futura Tech Park,

C Block, 8th floor 334,

Old Mahabalipuram Road,

Sholinganallur, Chennai, Tamil Nadu, Pincode - 600119.

𝐋𝐢𝐧𝐤𝐞𝐝𝐈𝐧: https://www.linkedin.com/company/price-watch-ai/

𝐅𝐚𝐜𝐞𝐛𝐨𝐨𝐤: https://www.facebook.com/people//61568490385598/

𝐓𝐰𝐢𝐭𝐭𝐞𝐫: https://x.com/pricewatchai

𝐖𝐞𝐛𝐬𝐢𝐭𝐞: https://www.price-watch.ai/

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness