Base Oil Price Trend in Q3 2025: A Simple Market Overview

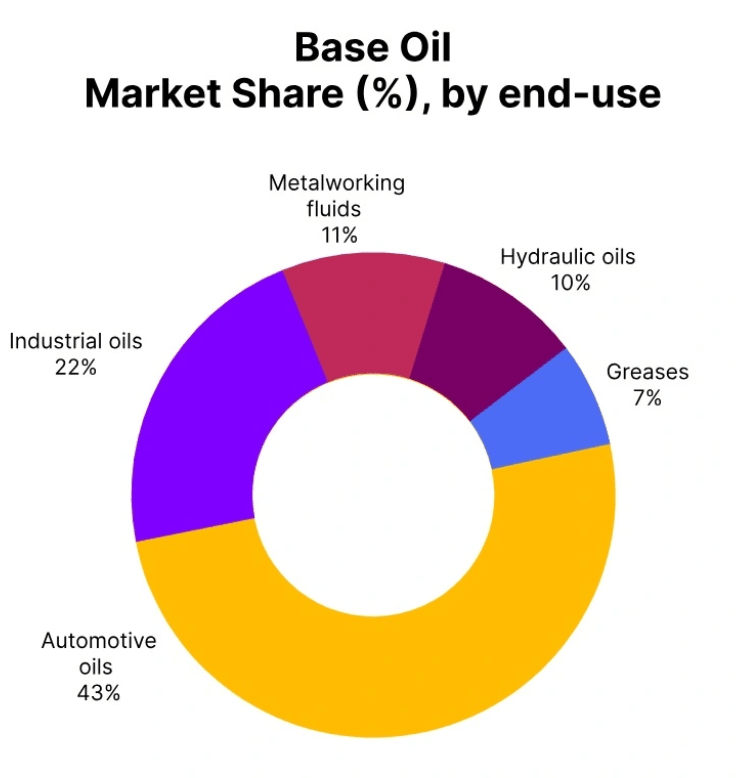

The global Base Oil Price Trend during the third quarter of 2025 showed a mostly weak and cautious market environment. In simple terms, prices in many regions either fell or stayed under pressure due to higher supply and lower demand. Base oil is an important raw material used in making lubricants, engine oils, and many industrial products, so its pricing often reflects the overall health of manufacturing and transportation sectors.

During Q3 2025, the market did not experience strong buying activity. Many buyers preferred to purchase only what they needed instead of stocking up, which is commonly called “cautious procurement.” This behavior played a big role in keeping prices low across several major producing regions.

Overall Global Market Situation

The global Base Oil Prices during this period remained largely bearish. A bearish market simply means that prices were generally moving downward or facing pressure. Across major exporting countries, quarterly price changes ranged from a drop of about 6.9% to a small increase of around 2.8%.

One of the main reasons behind this trend was oversupply. Many refineries continued to produce base oil at steady levels, but demand from industries such as automotive, manufacturing, and shipping remained moderate. When supply is higher than demand, prices naturally fall because sellers compete to attract buyers.

Please Submit Your Query For Base Oil Price Trend, Market Analysis and Forecast: https://www.price-watch.ai/book-a-demo/

Another factor was seasonal demand. During certain times of the year, especially late summer months, lubricant consumption tends to slow down. This seasonal pattern contributed to weaker buying interest in several regions.

Freight costs and shipping conditions remained stable throughout most global ports. However, stable freight did not help prices much because the real issue was weak demand, not transportation costs.

Regional Performance Differences

While the overall trend was downward, some regions showed different pricing patterns.

Declining Markets

Taiwan and Saudi Arabia recorded the biggest price drops during the quarter. Both markets experienced heavy supply pressure and reduced purchasing activity from international buyers.

Other Asian markets such as Singapore, South Korea, and Indonesia also saw moderate price declines. Suppliers in these countries had to reduce their offers to stay competitive in the global market.

These price adjustments reflect a common market reality — when multiple producers compete for limited demand, they often lower prices to secure sales.

The UAE: A Rare Exception

The United Arab Emirates stood out as the only market to show a price increase during Q3 2025. This was mainly due to steady production levels and consistent export inquiries from buyers in nearby regions.

The UAE’s strong trade relationships and stable supply chain helped maintain demand, which allowed sellers to slightly raise their offers despite the overall weak global environment.

This shows how regional demand conditions can sometimes protect prices even when the global market is under pressure.

Base Oil Price Trend in the USA

In the United States, the Base Oil Price Trend showed some signs of stability during the third quarter of 2025. Export prices for Group II 220N base oil from New Orleans increased slightly by around 0.7%.

Prices during the quarter ranged between approximately USD 660 and USD 763 per metric ton. This modest increase suggests that the US market was slowly recovering after earlier price declines in the year.

One key reason for this stabilization was consistent export demand. US suppliers continued to ship cargoes to international markets, which helped maintain steady trading activity.

However, prices dropped again in September by about 4.3%. This decline reflected ongoing global oversupply and reduced buying interest from downstream sectors.

Despite this dip, US base oil remained competitively priced compared to other regions. This helped maintain confidence among international buyers.

Base Oil Price Trend in South Korea

South Korea is one of the major exporters of base oil in Asia, and its pricing often reflects regional market conditions.

In Q3 2025, South Korea’s Base Oil Price Trend showed a decline of around 4%. Prices for Group II 500N base oil from Daesan Port ranged between USD 915 and USD 998 per metric ton.

The main reason for this decline was oversupply in the Asian market. Many refiners in the region continued to produce large volumes, while demand from lubricant manufacturers remained slow.

In September, prices dropped further by about 3.1%. This continued decline reflected cautious buying behavior and weak signals from end-user industries.

South Korean suppliers responded by adjusting their pricing strategies to remain competitive in international markets.

Base Oil Price Trend in Taiwan

Taiwan experienced the sharpest price decline among major exporters during Q3 2025. The Base Oil Price Trend in Taiwan dropped by about 6.9%.

Prices for Group II 500N base oil from Mailiao Port ranged between USD 890 and USD 973 per metric ton.

This strong decline happened mainly because of weak global demand and rising supply pressure. Taiwanese refiners had to reduce their offers to attract buyers and prevent inventory buildup.

In September, prices fell further by nearly 4.7%, showing that demand remained soft even toward the end of the quarter.

Market participants expect selective buying patterns to continue in the coming months, as buyers wait for clearer signs of demand recovery.

Key Factors Affecting Base Oil Price Trend

Several important factors influenced the global Base Oil Price Trend during Q3 2025:

1. Oversupply

Refineries maintained steady production levels, leading to more supply than demand.

2. Weak Industrial Demand

Slower activity in automotive, manufacturing, and shipping sectors reduced lubricant consumption.

3. Cautious Buying Behavior

Many buyers avoided large purchases and preferred short-term buying strategies.

4. Stable Freight Costs

Shipping costs remained steady but did not significantly influence price direction.

5. Regional Market Differences

Some regions, like the UAE, maintained stable demand, supporting higher prices.

Market Outlook

Looking ahead, the global Base Oil Price Trend is expected to depend largely on demand recovery in key industries. If manufacturing activity improves and lubricant consumption increases, prices may stabilize or rise.

However, if oversupply continues and buyers remain cautious, prices could remain under pressure in the near term.

Market participants are closely watching economic conditions, refinery output levels, and trade flows to understand future price movements.

Conclusion

In simple terms, the global Base Oil Price Trend during Q3 2025 reflected a weak market environment driven by oversupply and cautious demand. Most regions experienced price declines, while only a few markets showed stability or growth.

The USA saw mild stabilization followed by a small decline, South Korea and Taiwan faced notable price drops, and the UAE stood out with a modest increase.

Overall, the quarter highlighted the importance of supply-demand balance in determining base oil prices. As industries gradually recover and market conditions evolve, the base oil market will continue to adjust accordingly.

About Price Watch™ AI

Price-Watch AI is an India-based, independent raw material price reporting agency that provides real-time price forecasts and data-driven insights into global raw material markets. Price-Watch AI specializes in tracking raw material prices, analyzing market trends, and delivering timely updates on plant shutdowns, supply disruptions, capacity expansions, and demand-supply dynamics. The Price-Watch AI platform empowers manufacturers, traders, and procurement professionals to make faster, smarter decisions. Leveraging AI-powered forecasting and over a decade of historical data, Price-Watch AI transforms market volatility into actionable opportunity.

Futura Tech Park,

C Block, 8th floor 334,

Old Mahabalipuram Road,

Sholinganallur, Chennai, Tamil Nadu, Pincode - 600119.

𝐋𝐢𝐧𝐤𝐞𝐝𝐈𝐧: https://www.linkedin.com/company/price-watch-ai/

𝐅𝐚𝐜𝐞𝐛𝐨𝐨𝐤: https://www.facebook.com/people//61568490385598/

𝐓𝐰𝐢𝐭𝐭𝐞𝐫: https://x.com/pricewatchai

𝐖𝐞𝐛𝐬𝐢𝐭𝐞: https://www.price-watch.ai/

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness