Methylene Diphenyl Diisocyanate (MDI) Price Trend Guide: Historical Performance, Key Market Drivers, and Forecast Analysis

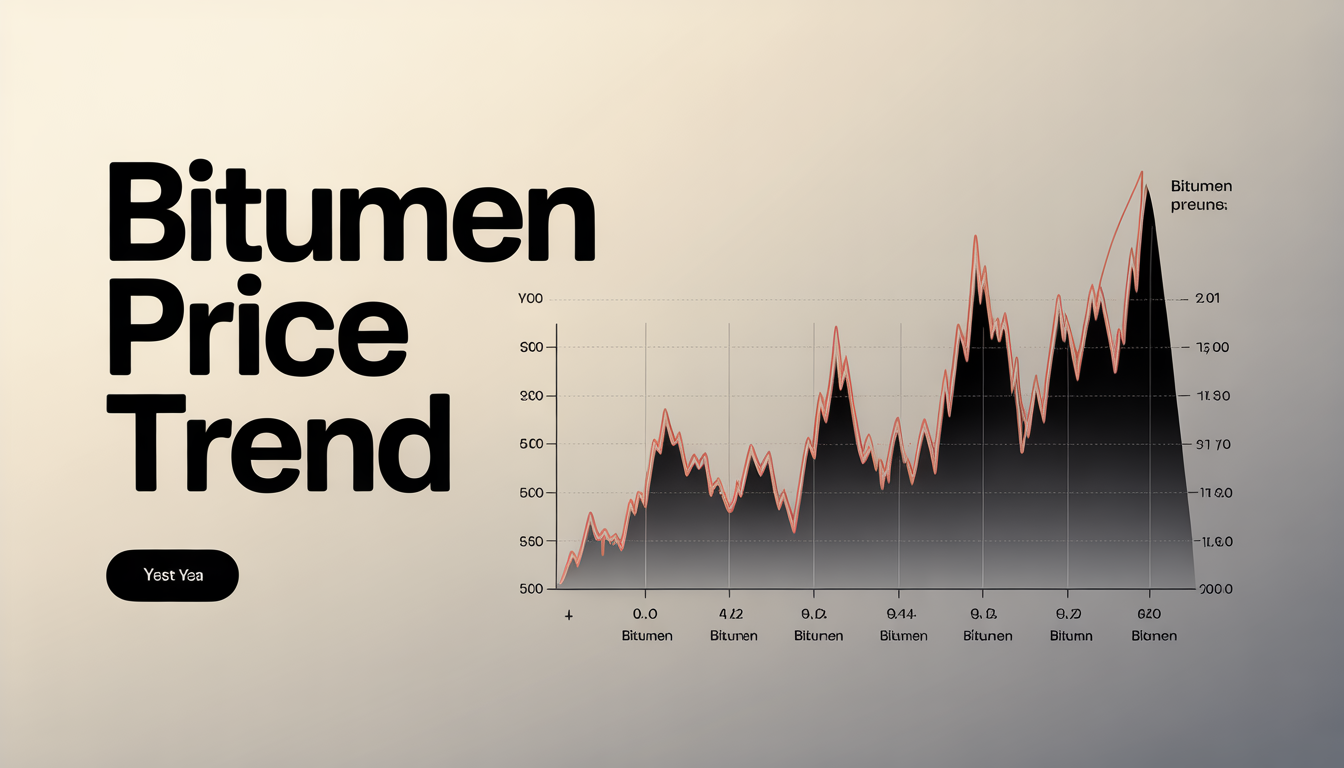

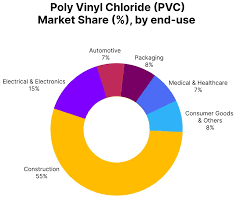

Methylene Diphenyl Diisocyanate Price Trend commonly known as MDI, is an important chemical used mainly in the production of polyurethane products. These products are part of our daily lives, from mattresses and sofas to insulation materials, adhesives, and coatings. Because MDI is so closely connected to construction, furniture, automotive, and appliance industries, its price trend often reflects what is happening in the wider economy. Over time, the Methylene Diphenyl Diisocyanate price trend has shown noticeable ups and downs, influenced by raw materials, energy costs, and overall market demand.

Please Submit Your Query for Methylene Diphenyl Diisocyanate Price Trend, demand-supply, suppliers, market analysis:

https://www.price-watch.ai/book-a-demo/

Factors Influencing Methylene Diphenyl Diisocyanate Prices

One of the main factors affecting the Methylene Diphenyl Diisocyanate price trend is the cost of raw materials. MDI is produced using benzene and aniline, both of which are derived from crude oil. When crude oil prices rise, the cost of these raw materials also increases, putting pressure on MDI prices. On the other hand, when oil prices are stable or falling, manufacturers may get some cost relief, which can help keep MDI prices steady.

Energy costs also play a big role. The production of MDI is energy-intensive, requiring significant electricity and heat. Any increase in power, gas, or fuel prices directly affects production expenses. In many regions, changes in energy policies or fuel shortages have led to higher manufacturing costs, which are often passed on to buyers through higher MDI prices.

Impact of Supply and Demand on MDI Price Trend

Supply and demand balance is another key driver of the Methylene Diphenyl Diisocyanate price trend. When construction and manufacturing activities are strong, demand for polyurethane products increases. This leads to higher consumption of MDI, pushing prices upward. During periods of economic slowdown, demand from major sectors such as construction and automotive may weaken, resulting in lower MDI consumption and softer prices.

Supply disruptions can also cause sudden price changes. Maintenance shutdowns at production plants, unexpected technical issues, or logistics problems can reduce MDI availability in the market. When supply tightens while demand remains steady, prices tend to rise quickly. In contrast, when new production capacities come online or inventories build up, the market may experience oversupply, leading to price corrections.

Regional Trends in Methylene Diphenyl Diisocyanate Market

The Methylene Diphenyl Diisocyanate price trend can vary across regions due to local market conditions. In Asia, especially in countries with strong manufacturing and construction sectors, MDI demand is often high. Rapid urban development and infrastructure projects usually support stable or rising prices in this region. However, any slowdown in construction activity can quickly change the price direction.

Conclusion

The Methylene Diphenyl Diisocyanate price trend is shaped by a combination of raw material costs, energy prices, supply-demand balance, and global economic conditions. As MDI remains a crucial component in many everyday products, its price behavior closely follows industrial activity and market sentiment. Understanding these factors helps businesses and buyers make informed decisions and prepare for future market changes in a more confident way.

Please Submit Your Query for Methylene Diphenyl Diisocyanate Price Trend, demand-supply, suppliers, market analysis:

https://www.price-watch.ai/book-a-demo/

About Price Watch™ AI

Price-Watch AI is an India-based, independent raw material price reporting agency that provides real-time price forecasts and data-driven insights into global raw material markets. Price-Watch AI specializes in tracking raw material prices, analyzing market trends, and delivering timely updates on plant shutdowns, supply disruptions, capacity expansions, and demand-supply dynamics. The Price-Watch AI platform empowers manufacturers, traders, and procurement professionals to make faster, smarter decisions. Leveraging AI-powered forecasting and over a decade of historical data, Price-Watch AI transforms market volatility into actionable opportunity.

Futura Tech Park,

C Block, 8th floor 334,

Old Mahabalipuram Road,

Sholinganallur, Chennai,

Tamil Nadu, Pincode - 600119.

LinkedIn:

https://www.linkedin.com/company/price-watch-ai/

Facebook:

https://www.facebook.com/people/Price-Watch/61568490385598/

Twitter:

https://x.com/pricewatchai

Website:

https://www.price-watch.ai/Methylene Diphenyl Diisocyanate (MDI) Price Trend Guide: Historical Performance, Key Market Drivers, and Forecast Analysis

Methylene Diphenyl Diisocyanate Price Trend commonly known as MDI, is an important chemical used mainly in the production of polyurethane products. These products are part of our daily lives, from mattresses and sofas to insulation materials, adhesives, and coatings. Because MDI is so closely connected to construction, furniture, automotive, and appliance industries, its price trend often reflects what is happening in the wider economy. Over time, the Methylene Diphenyl Diisocyanate price trend has shown noticeable ups and downs, influenced by raw materials, energy costs, and overall market demand.

👉 👉 👉 Please Submit Your Query for Methylene Diphenyl Diisocyanate Price Trend, demand-supply, suppliers, market analysis:https://www.price-watch.ai/book-a-demo/

Factors Influencing Methylene Diphenyl Diisocyanate Prices

One of the main factors affecting the Methylene Diphenyl Diisocyanate price trend is the cost of raw materials. MDI is produced using benzene and aniline, both of which are derived from crude oil. When crude oil prices rise, the cost of these raw materials also increases, putting pressure on MDI prices. On the other hand, when oil prices are stable or falling, manufacturers may get some cost relief, which can help keep MDI prices steady.

Energy costs also play a big role. The production of MDI is energy-intensive, requiring significant electricity and heat. Any increase in power, gas, or fuel prices directly affects production expenses. In many regions, changes in energy policies or fuel shortages have led to higher manufacturing costs, which are often passed on to buyers through higher MDI prices.

Impact of Supply and Demand on MDI Price Trend

Supply and demand balance is another key driver of the Methylene Diphenyl Diisocyanate price trend. When construction and manufacturing activities are strong, demand for polyurethane products increases. This leads to higher consumption of MDI, pushing prices upward. During periods of economic slowdown, demand from major sectors such as construction and automotive may weaken, resulting in lower MDI consumption and softer prices.

Supply disruptions can also cause sudden price changes. Maintenance shutdowns at production plants, unexpected technical issues, or logistics problems can reduce MDI availability in the market. When supply tightens while demand remains steady, prices tend to rise quickly. In contrast, when new production capacities come online or inventories build up, the market may experience oversupply, leading to price corrections.

Regional Trends in Methylene Diphenyl Diisocyanate Market

The Methylene Diphenyl Diisocyanate price trend can vary across regions due to local market conditions. In Asia, especially in countries with strong manufacturing and construction sectors, MDI demand is often high. Rapid urban development and infrastructure projects usually support stable or rising prices in this region. However, any slowdown in construction activity can quickly change the price direction.

Conclusion

The Methylene Diphenyl Diisocyanate price trend is shaped by a combination of raw material costs, energy prices, supply-demand balance, and global economic conditions. As MDI remains a crucial component in many everyday products, its price behavior closely follows industrial activity and market sentiment. Understanding these factors helps businesses and buyers make informed decisions and prepare for future market changes in a more confident way.

👉 👉 👉 Please Submit Your Query for Methylene Diphenyl Diisocyanate Price Trend, demand-supply, suppliers, market analysis:https://www.price-watch.ai/book-a-demo/

About Price Watch™ AI

Price-Watch AI is an India-based, independent raw material price reporting agency that provides real-time price forecasts and data-driven insights into global raw material markets. Price-Watch AI specializes in tracking raw material prices, analyzing market trends, and delivering timely updates on plant shutdowns, supply disruptions, capacity expansions, and demand-supply dynamics. The Price-Watch AI platform empowers manufacturers, traders, and procurement professionals to make faster, smarter decisions. Leveraging AI-powered forecasting and over a decade of historical data, Price-Watch AI transforms market volatility into actionable opportunity.

Futura Tech Park,

C Block, 8th floor 334,

Old Mahabalipuram Road,

Sholinganallur, Chennai,

Tamil Nadu, Pincode - 600119.

LinkedIn: https://www.linkedin.com/company/price-watch-ai/

Facebook: https://www.facebook.com/people/Price-Watch/61568490385598/

Twitter: https://x.com/pricewatchai

Website: https://www.price-watch.ai/