Benzene Price Trend in Q3 2025: A Simple Market Overview

The global chemical market often changes depending on many small and large factors, and benzene is no exception. In the third quarter of 2025,

the Benzene Price Trend showed mixed movements across regions. Prices did not move sharply up or down, but instead stayed within a limited range. This shows that the market remained mostly stable, even though there were small pressures from raw materials, demand changes, and global economic conditions.

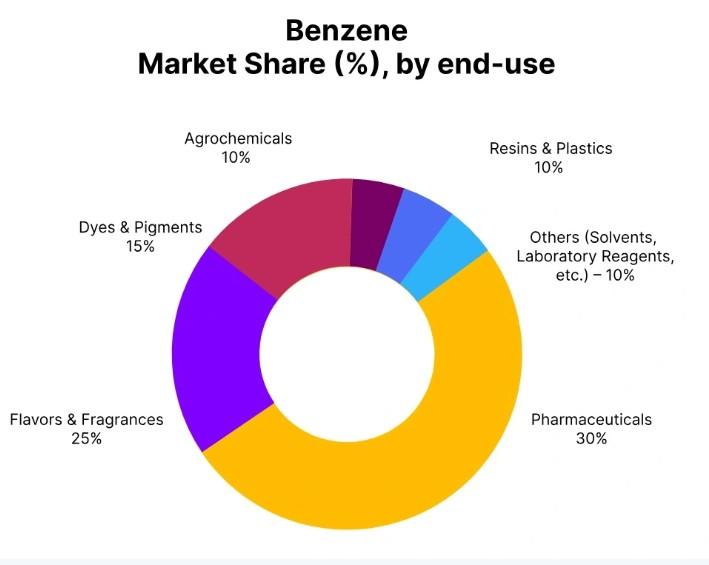

Benzene is a very important raw material used to make many everyday products. It is widely used in the production of resins, styrene, synthetic rubber, plastics, and other industrial materials. Because of this, its price often depends on how these industries are performing. When these sectors run smoothly, benzene demand stays strong, and prices remain stable. When demand slows down, prices may fall slightly.

During Q3 2025, the benzene market stayed balanced overall. There was no major shortage or oversupply. Production rates were steady, and most companies managed their inventory carefully. This helped prevent sudden price spikes or sharp declines. In simple words, the market behaved in a controlled and predictable way.

Factors Influencing the Benzene Price Trend

Many factors affected the Benzene Price Trend in this quarter. One of the main influences was upstream costs. Since benzene is derived from petroleum-based products, any changes in crude oil prices directly affect its cost. When crude oil prices fluctuate, benzene production costs also change.

Please Submit Your Query For Benzene Price Trend, Market Analysis and Forecast: https://www.price-watch.ai/book-a-demo/

Throughout the quarter, crude oil prices moved up and down slightly. These changes created small pressure on benzene prices but did not lead to any extreme movements. Producers and buyers both adjusted their strategies carefully to avoid risks.

Another important factor was downstream demand. Industries like resins, styrene, and synthetic materials continued to consume benzene regularly. This steady demand helped maintain price stability. If these industries had slowed down significantly, prices could have dropped more.

Seasonal demand also played a role. Some months typically see lower industrial activity, which reduces buying interest. Combined with global economic uncertainties, this created cautious market sentiment. Buyers preferred to purchase only what they needed instead of stocking large quantities.

Supply Chain and Freight Conditions

Supply chain conditions improved during the quarter. Freight and logistics became smoother compared to previous periods. Ports operated more efficiently, and vessel availability improved. These improvements helped reduce transportation delays.

Better shipping conditions usually support price stability. When goods move easily from one region to another, supply remains consistent, and markets do not face sudden shortages. In Q3 2025, this smoother flow of benzene across regions helped keep the market balanced.

Spot trading remained moderate. Most companies relied on long-term contracts instead of buying from the spot market. This approach reduced sudden price changes because contractual volumes offer more predictability.

Overall, the combination of stable supply and steady logistics played a key role in keeping the Benzene Price Trend relatively calm.

South Korea Market Overview

South Korea is an important exporter of benzene, especially from the port of Busan. The country’s pricing often influences the Asian market. In Q3 2025, the Benzene Price Trend in South Korea showed a small decline.

Prices registered a marginal drop of about 0.97% during the quarter. FOB Busan export prices ranged between USD 710 and USD 745 per metric ton. This shows that the price movement was narrow and not dramatic.

Domestic demand remained steady in South Korea. Refineries maintained balanced production levels, and there were no major shutdowns or supply disruptions. Regular buying from styrene and resin manufacturers supported the market.

Export activity stayed moderate. There were limited opportunities for arbitrage between regions, which means traders could not benefit much from price differences. Because of this, trading volumes remained controlled.

Inventory levels were also well managed. When stocks are neither too high nor too low, prices usually stay stable. This was exactly the case in South Korea.

September Price Movement

Although the quarter was mostly stable, September showed a bit more weakness. Benzene prices in South Korea fell by around 2.86% during this month.

The main reason was slower demand from downstream sectors like Styrene Monomer and Cumene. When these industries reduce production, they buy less benzene, which puts pressure on prices.

At the same time, buyers became cautious. Instead of purchasing large volumes, they waited to see how the market would move. Weak export activity also contributed to lower demand.

Fluctuating crude oil prices added further uncertainty. Since feedstock costs were not stable, both buyers and sellers hesitated to make aggressive moves. This cautious behavior created a slightly bearish market sentiment.

Even with this decline, the price fall was not extreme. It remained within a manageable range, showing that the overall Benzene Price Trend was still stable rather than volatile.

Overall Market Sentiment

Looking at the bigger picture, the benzene market showed resilience during Q3 2025. Despite small challenges, prices did not experience sharp rises or sudden crashes. This reflects a healthy balance between supply and demand.

Most market participants adopted a practical approach. They focused on steady operations rather than aggressive trading. This helped reduce risks and maintain stability.

From a general business perspective, this kind of market is often preferred. Extreme volatility can create uncertainty and financial losses. A stable trend allows companies to plan better and manage costs more effectively.

Outlook for the Coming Months

The outlook for the Benzene Price Trend remains cautiously stable. Prices are likely to move in line with feedstock costs and overall economic conditions.

If crude oil prices rise sharply, benzene prices may increase as well. On the other hand, if downstream demand weakens further, prices may soften. However, as long as supply remains balanced and logistics stay smooth, drastic changes are unlikely.

Market participants will continue to watch global economic signals, refinery operations, and demand from key industries. These factors will guide the next direction of the market.

Conclusion

To summarize, the Benzene Price Trend in Q3 2025 showed a mixed but mostly stable pattern. Fluctuating upstream costs, steady downstream demand, and balanced production kept prices within a narrow range. Improved freight conditions and careful inventory management also supported stability.

In South Korea, prices saw only a small decline, with FOB Busan rates staying between USD 710 and USD 745 per metric ton. Even the September drop was moderate and mainly caused by weak downstream demand and cautious buying.

Overall, the benzene market demonstrated strength and resilience. Instead of dramatic price swings, it followed a calm and predictable path. This stability is a positive sign for businesses that depend on benzene, helping them plan better and operate with confidence.

As we move forward, the market is expected to remain steady, with changes mainly linked to feedstock prices and global economic trends.

Please Submit Your Query For Benzene Price Trend, Market Analysis and Forecast: https://www.price-watch.ai/book-a-demo/

About Price Watch™ AI

Price-Watch AI is an India-based, independent raw material price reporting agency that provides real-time price forecasts and data-driven insights into global raw material markets. Price-Watch AI specializes in tracking raw material prices, analyzing market trends, and delivering timely updates on plant shutdowns, supply disruptions, capacity expansions, and demand-supply dynamics. The Price-Watch AI platform empowers manufacturers, traders, and procurement professionals to make faster, smarter decisions. Leveraging AI-powered forecasting and over a decade of historical data, Price-Watch AI transforms market volatility into actionable opportunity.

Futura Tech Park,

C Block, 8th floor 334,

Old Mahabalipuram Road,

Sholinganallur, Chennai, Tamil Nadu, Pincode - 600119.

𝐋𝐢𝐧𝐤𝐞𝐝𝐈𝐧: https://www.linkedin.com/company/price-watch-ai/

𝐅𝐚𝐜𝐞𝐛𝐨𝐨𝐤: https://www.facebook.com/people//61568490385598/

𝐓𝐰𝐢𝐭𝐭𝐞𝐫: https://x.com/pricewatchai

𝐖𝐞𝐛𝐬𝐢𝐭𝐞: https://www.price-watch.ai/

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness