-

Fil d’actualités

- EXPLORER

-

Pages

-

Groupes

-

Evènements

-

Blogs

-

Marketplace

-

Forums

Cumene Price Trend: A Simple Look at What Happened and Why It Matters

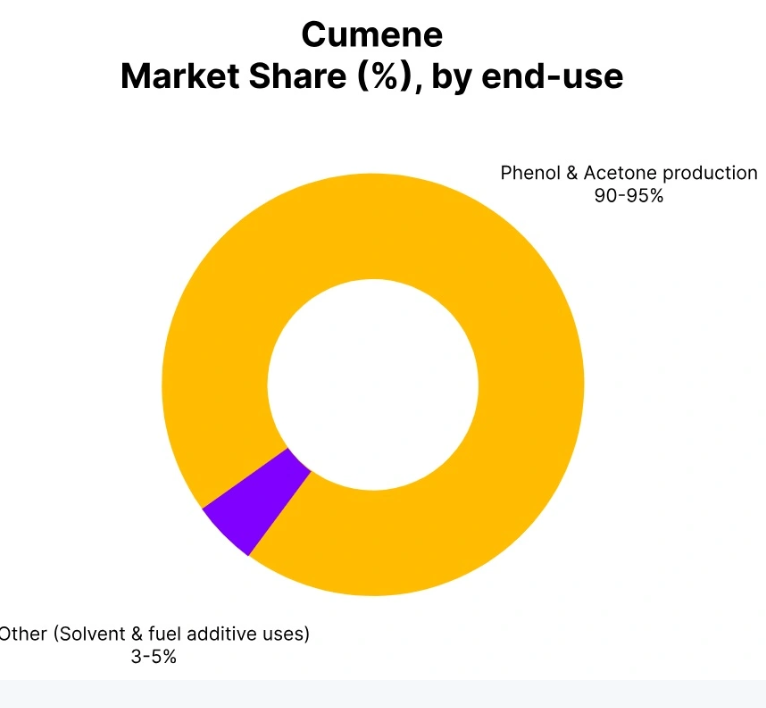

The Cumene Price Trend in recent times has caught the attention of many people involved in the chemical, manufacturing, and trading industries. Cumene may not be a household name, but it plays an important role in everyday products. It is mainly used to make phenol and acetone, which are further used in plastics, paints, adhesives, construction materials, electronics, and automotive parts. Because of this wide usage, changes in cumene prices often reflect broader market conditions in the chemical industry.

In Q3 2025, the global cumene market went through a noticeable price correction. Prices fell in several key regions, including the United States and Europe. This decline did not happen overnight or due to a single event. Instead, it was the result of a mix of weak demand, comfortable supply levels, cautious buying behavior, and softer feedstock prices. When we look at the Cumene Price Trend during this period, it tells a story of balance tipping slightly in favor of buyers rather than sellers.

Understanding the Basics Behind Cumene Pricing

To understand the Cumene Prices, it helps to first look at how cumene is produced and sold. Cumene is made using benzene and propylene as raw materials. Among these, benzene prices play a major role in deciding cumene production costs. When benzene prices fall or remain stable, producers can afford to sell cumene at lower prices without hurting their margins too much.

In Q3 2025, benzene feedstock prices were relatively soft. This was one of the key reasons cumene prices moved downward. Producers did not face much cost pressure, and at the same time, demand from buyers was not strong enough to support higher prices. This combination naturally pushed the Cumene Price Trend into a declining direction.

Please Submit Your Query For Cumene Price Trend, Market Analysis and Forecast: https://www.price-watch.ai/book-a-demo/

Demand Side: Why Buyers Stayed Careful

One of the most important reasons behind the falling Cumene Price Trend was weak demand from downstream industries. Phenol and acetone manufacturers, who are the biggest consumers of cumene, were buying only what they needed. Many of them already had enough inventory, and their own product demand was not growing fast.

In many markets, buyers preferred to stay cautious. Instead of placing large orders, they spread out their purchases and avoided stocking more material than necessary. This kind of buying behavior sends a clear signal to the market: there is no urgency. When sellers notice this, they often reduce prices slightly to keep material moving.

This cautious mindset was visible across regions. Even when logistics faced minor disruptions, such as weather-related issues in the United States, buyers did not rush to secure extra volumes. This further added to the softness in the Cumene Price Trend.

Supply Conditions: No Major Shortages

Another important factor shaping the Cumene Price Trend was stable and balanced supply. There were no major plant shutdowns or long-term production issues reported during the quarter. Most producers operated normally and managed their inventories carefully.

Because supply was steady and demand was weak, the market did not face any shortages. In fact, many producers were more focused on avoiding excess stock than on pushing sales aggressively. This led to a situation where prices gradually adjusted downward to match the real demand in the market.

When supply chains run smoothly and stocks are well managed, price volatility usually stays limited. That is exactly what happened during Q3 2025. The Cumene Price Trend showed a controlled decline rather than a sharp crash.

United States: A Calm but Soft Market

In the United States, the Cumene Price Trend followed the global pattern. Prices declined moderately throughout the quarter. Export prices from major ports such as Houston moved lower by a small percentage, reflecting reduced buying interest from both domestic and international customers.

Downstream industries like phenol and acetone producers were not in a hurry to buy. Many of them were operating at steady but not aggressive production rates. As a result, cumene demand stayed muted. Producers responded by keeping inventories in check and offering competitive pricing rather than chasing volume.

Even when some weather-related logistics challenges appeared, the overall supply situation remained comfortable. This prevented any sudden price spikes. By the end of the quarter, the Cumene Price Trend in the United States clearly showed a soft tone, driven more by sentiment than by any major disruption.

Europe and Italy: Freight and Demand Effects

In Europe, and especially in Italy, the Cumene Price Trend was influenced by a mix of lower freight costs and subdued regional demand. Import prices into ports like Genoa declined as shipping costs eased, making imported material more affordable.

European chemical markets were already facing slower growth during this period. Construction and manufacturing activity did not show strong momentum, which directly affected demand for phenol-based products. As a result, buyers had little motivation to accept higher prices for cumene.

Currency stability between the euro and the dollar offered some support, but it was not enough to offset the pressure from weak demand. With plenty of material available and no immediate supply risks, prices continued to trend downward through the quarter.

Market Sentiment: Waiting Rather Than Acting

One of the most interesting aspects of the Cumene Price Trend in Q3 2025 was market sentiment. Both buyers and sellers appeared cautious. Buyers waited for better price clarity, while sellers focused on protecting margins and managing stock.

There was very little aggressive trading activity. Instead, most deals were done on a need-basis. This kind of environment usually leads to slow, steady price adjustments rather than sudden movements. It also shows that the market was not in crisis, just going through a temporary correction.

Long-Term View: Growth Still Matters

Even though the Cumene Price Trend showed a decline in Q3 2025, the long-term outlook remains positive. Cumene demand is closely tied to industries like automotive, construction, electronics, and chemicals. Over time, these sectors are expected to grow, especially in developing economies.

Capacity additions, improved supply chains, and better production efficiency are also helping stabilize the market. These factors reduce the risk of extreme price swings and support long-term market health. In other words, short-term price weakness does not change the importance of cumene in the global chemical industry.

Conclusion: What the Cumene Price Trend Really Tells Us

The Cumene Price Trend in Q3 2025 reflects a market that is adjusting rather than collapsing. Prices moved lower mainly due to weak demand, stable supply, and softer raw material costs. Buyers stayed careful, sellers stayed disciplined, and the market found a new balance.

For industry participants, this period highlighted the importance of inventory control, realistic demand planning, and close monitoring of feedstock prices. While short-term price movements can feel discouraging, they are often part of a normal cycle.

Overall, the Cumene Price Trend during this period showed that the market is resilient, well-supplied, and still supported by strong long-term fundamentals. As demand gradually improves and downstream industries regain momentum, the market is likely to stabilize further and move forward with confidence.

About Price Watch™ AI

Price-Watch AI is an India-based, independent raw material price reporting agency that provides real-time price forecasts and data-driven insights into global raw material markets. Price-Watch AI specializes in tracking raw material prices, analyzing market trends, and delivering timely updates on plant shutdowns, supply disruptions, capacity expansions, and demand-supply dynamics. The Price-Watch AI platform empowers manufacturers, traders, and procurement professionals to make faster, smarter decisions. Leveraging AI-powered forecasting and over a decade of historical data, Price-Watch AI transforms market volatility into actionable opportunity.

Futura Tech Park,

C Block, 8th floor 334,

Old Mahabalipuram Road,

Sholinganallur, Chennai, Tamil Nadu, Pincode - 600119.

𝐋𝐢𝐧𝐤𝐞𝐝𝐈𝐧: https://www.linkedin.com/company/price-watch-ai/

𝐅𝐚𝐜𝐞𝐛𝐨𝐨𝐤: https://www.facebook.com/people//61568490385598/

𝐓𝐰𝐢𝐭𝐭𝐞𝐫: https://x.com/pricewatchai

𝐖𝐞𝐛𝐬𝐢𝐭𝐞: https://www.price-watch.ai/

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jeux

- Gardening

- Health

- Domicile

- Literature

- Music

- Networking

- Autre

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness