-

Новости

- ИССЛЕДОВАТЬ

-

Страницы

-

Группы

-

Мероприятия

-

Статьи пользователей

-

Marketplace

-

Форумы

Ethylene Price Trend: A Clear and Simple View of Market Movements in Q3 2025

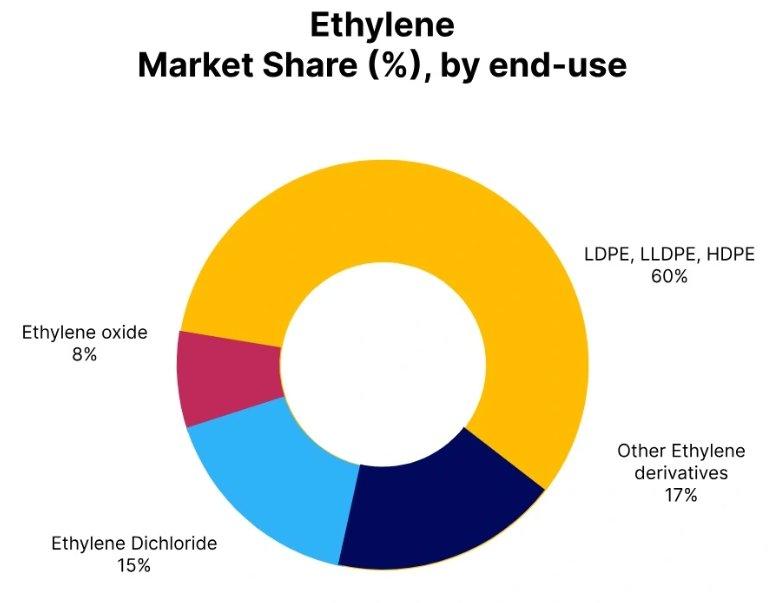

The Ethylene Price Trend is often seen as a reflection of the overall health of the petrochemical and manufacturing industries. Ethylene is one of the most important building blocks in the chemical world. It is widely used to produce polyethylene, PVC, ethylene glycol, and many other products that eventually find their way into packaging, construction materials, automotive parts, textiles, and household goods. Because ethylene is so closely tied to everyday products, changes in its price usually tell a larger story about demand, supply, and economic activity.

In Q3 2025, the global ethylene market showed mixed performance across regions. Some markets experienced strong price increases, while others saw mild declines or stable pricing. This uneven behavior clearly shows that the Ethylene Price Trend is heavily influenced by local market conditions rather than a single global factor. Demand from downstream industries, feedstock costs, freight rates, and regional supply constraints all played an important role during the quarter.

What Drives the Ethylene Price Trend?

To understand the Ethylene Prices, it is important to look at how ethylene is produced and consumed. Ethylene is typically made by cracking hydrocarbons such as ethane, naphtha, or propane. The choice of feedstock depends on the region. For example, North and South America rely more on ethane, while Europe and parts of Asia use naphtha-based crackers.

Feedstock prices directly affect production costs. When ethane or naphtha prices rise, ethylene producers often pass those costs on to buyers. On the demand side, ethylene consumption depends heavily on industries like packaging, construction, automotive, and consumer goods. When these sectors are performing well, ethylene demand usually increases, supporting higher prices.

In Q3 2025, these factors did not move in the same direction everywhere. This resulted in a regionally diverse Ethylene Price Trend.

Please Submit Your Query For Ethylene Price Trend, Market Analysis and Forecast: https://www.price-watch.ai/book-a-demo/

Global Overview: A Regionally Split Market

On a global level, the Ethylene Price Trend during Q3 2025 remained balanced but uneven. Western markets showed stronger price performance, supported by firm downstream demand and occasional supply tightness. In contrast, parts of Europe faced softer demand, which kept prices under pressure despite stable feedstock availability.

Asia-Pacific markets showed mixed results. Some countries saw moderate price increases due to local demand improvements, while others struggled with competition from exports and cautious buying behavior. Meanwhile, the Middle East remained relatively stable, supported by consistent supply and balanced domestic and export demand.

Overall, the global ethylene market did not experience extreme volatility. Instead, pricing reflected local realities, showing that ethylene remains a region-driven market rather than a fully synchronized global one.

Argentina: Strong Demand Driving Prices Higher

Argentina stood out during Q3 2025 with a clearly bullish Ethylene Price Trend. Prices increased strongly, supported by robust domestic demand from polyethylene producers and other downstream chemical sectors. Packaging, construction materials, and industrial goods manufacturing all showed steady consumption, creating strong pull-through demand for ethylene.

Another key factor behind the rising Ethylene Price Trend in Argentina was higher import costs. Ethylene imports from the United States became more expensive due to rising ethane feedstock prices in the U.S. Gulf Coast. On top of that, freight and logistics costs added further pressure, increasing the final landed cost of material.

Even though supply availability remained stable, there was limited flexibility to quickly increase volumes. This allowed prices to move upward throughout the quarter. By September 2025, prices had surged further, showing that demand momentum remained strong and buyers were willing to accept higher prices to secure supply.

From a market perspective, Argentina’s experience shows how strong domestic demand combined with rising import costs can significantly influence the Ethylene Price Trend, even when global markets are more balanced.

Belgium and Europe: Demand Weakness Weighing on Prices

In contrast to Argentina, the Ethylene Price Trend in Belgium and much of Europe was more subdued. During Q3 2025, prices remained under slight downward pressure. This was mainly due to weak demand from polymer producers and chemical derivative manufacturers.

Industries such as construction and automotive were operating below optimal levels in Europe, reducing the need for polyethylene and other ethylene-based products. As a result, ethylene buyers remained cautious and avoided aggressive purchasing.

Production conditions in Belgium were relatively stable. Local cracker output continued without major disruptions, and feedstock costs showed only moderate fluctuations. However, stable supply alone was not enough to support higher prices in the absence of strong demand.

Interestingly, September 2025 showed some signs of recovery, with prices increasing modestly from the previous month. This suggested a slight improvement in market sentiment, possibly due to limited restocking or expectations of better demand ahead. Still, the overall Ethylene Price Trend in Belgium remained shaped more by demand weakness than by supply constraints.

Asia-Pacific: Mixed Signals Across Markets

Asia-Pacific markets presented a mixed picture for the Ethylene Price Trend during Q3 2025. Some regions experienced price increases driven by local demand recovery and operational constraints, while others faced pressure from competitive exports and oversupply concerns.

China, as one of the largest ethylene consumers, played a key role in shaping regional sentiment. Import prices fluctuated depending on supply from neighboring countries like South Korea and changing demand from Chinese downstream industries. While certain sectors showed improvement, others remained cautious, leading to uneven buying behavior.

This mixed performance highlights how diverse the Asia-Pacific region is. Differences in industrial activity, government policies, and trade dynamics mean that the Ethylene Price Trend can vary significantly even within the same region.

Middle East: Stability and Balance

The Middle East stood out for its relatively stable Ethylene Price Trend in Q3 2025. Producers in the region benefited from consistent feedstock availability and well-established production infrastructure. Supply remained steady, and demand from both domestic and export markets was balanced.

Because of this stability, prices did not experience major swings. The Middle East continued to act as a reliable supplier to global markets, helping offset volatility elsewhere. This stability also provided buyers with confidence in long-term supply reliability.

Market Behavior: Caution with Optimism

Across regions, one common theme in the Ethylene Price Trend during Q3 2025 was cautious optimism. Buyers were careful with inventory levels, avoiding overstocking while still meeting production needs. Sellers, on the other hand, focused on managing margins and responding to local demand signals rather than chasing volume.

This balanced behavior helped prevent extreme price movements. Instead, the market adjusted gradually, reflecting real demand and cost conditions.

Long-Term Outlook: Why Ethylene Still Matters

Despite regional differences and short-term fluctuations, the long-term outlook for ethylene remains positive. Population growth, urbanization, and rising consumption of packaged goods continue to support demand for ethylene-based products.

The Ethylene Price Trend may move up or down in the short term, but the material’s importance in modern life ensures steady long-term demand. Investments in new capacity, efficiency improvements, and supply chain optimization are also helping stabilize the market over time.

Conclusion: What Q3 2025 Tells Us About the Ethylene Price Trend

The Ethylene Price Trend in Q3 2025 tells a clear story of regional diversity. Strong demand drove prices higher in markets like Argentina, while weak industrial activity kept prices under pressure in parts of Europe. Asia-Pacific showed mixed signals, and the Middle East remained stable.

Rather than pointing to a single global direction, the quarter highlighted how local demand, feedstock costs, and logistics shape ethylene pricing. For industry participants, this reinforces the importance of regional market awareness and flexible procurement strategies.

Overall, the Ethylene Price Trend during this period reflected a mature and responsive market—one that adjusts steadily to changing conditions while remaining supported by strong long-term fundamentals.

About Price Watch™ AI

Price-Watch AI is an India-based, independent raw material price reporting agency that provides real-time price forecasts and data-driven insights into global raw material markets. Price-Watch AI specializes in tracking raw material prices, analyzing market trends, and delivering timely updates on plant shutdowns, supply disruptions, capacity expansions, and demand-supply dynamics. The Price-Watch AI platform empowers manufacturers, traders, and procurement professionals to make faster, smarter decisions. Leveraging AI-powered forecasting and over a decade of historical data, Price-Watch AI transforms market volatility into actionable opportunity.

Futura Tech Park,

C Block, 8th floor 334,

Old Mahabalipuram Road,

Sholinganallur, Chennai, Tamil Nadu, Pincode - 600119.

𝐋𝐢𝐧𝐤𝐞𝐝𝐈𝐧: https://www.linkedin.com/company/price-watch-ai/

𝐅𝐚𝐜𝐞𝐛𝐨𝐨𝐤: https://www.facebook.com/people//61568490385598/

𝐓𝐰𝐢𝐭𝐭𝐞𝐫: https://x.com/pricewatchai

𝐖𝐞𝐛𝐬𝐢𝐭𝐞: https://www.price-watch.ai/

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Игры

- Gardening

- Health

- Главная

- Literature

- Music

- Networking

- Другое

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness