Methanol Price Trend: A Global Market Story from Q3 2025

The Methanol Price Trend during the third quarter of 2025 reflected a market that was neither fully stable nor sharply disruptive, but instead moved through a phase of moderate volatility. Across global regions, Methanol prices showed mixed behavior, shaped by regional demand differences, downstream industry performance, supply balance, and freight costs. For market participants, Q3 2025 was a period of careful decision-making rather than aggressive buying or selling.

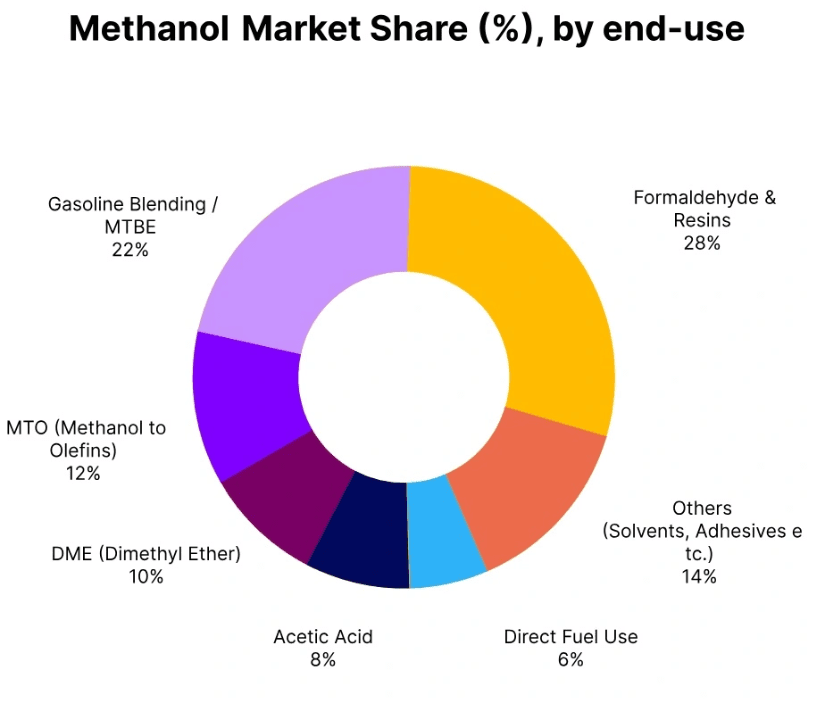

Methanol is widely used across industries such as chemicals, energy, construction materials, resins, and fuel blending. Because of its broad usage, Methanol prices tend to react quickly to changes in industrial activity, trade flows, and logistics. During Q3 2025, prices fluctuated between 5% and 8% across major global markets, highlighting a market that was active but cautious.

Global Overview of Methanol Price Trend in Q3 2025

On a global level, the Methanol Prices was influenced by uneven demand recovery and varying supply conditions. Some regions experienced firm prices due to tight availability and strong downstream demand, while others faced price pressure from ample inventories and slow industrial consumption.

Freight costs played an important role, especially in CIF markets such as Asia and Latin America. Changes in shipping availability and freight rates directly affected landed prices, making logistics a key factor in price formation. Buyers in these regions remained cautious, often delaying purchases in anticipation of better price opportunities.

Please Submit Your Query For Methanol Price Trend, Market Analysis and Forecast: https://www.price-watch.ai/book-a-demo/

Meanwhile, North America and Mexico stood out with firmer pricing trends, supported by tight supply conditions and strong demand from the MTBE sector. In contrast, Europe and China saw moderate declines, reflecting weaker industrial activity and sufficient stock levels.

Overall, the global Methanol market in Q3 2025 showed resilience in some regions, softness in others, and a general sense of uncertainty. The market did not collapse, but it also lacked strong upward momentum.

Methanol Price Trend in the Netherlands

In Europe, the Netherlands served as a key reference point for Methanol pricing, particularly through FD Rotterdam assessments. During Q3 2025, Methanol prices in the Netherlands declined by around 4.86%, with prices ranging between USD 285 and USD 320 per metric ton.

The Methanol Price Trend in the Netherlands clearly reflected the broader European market sentiment. Demand from downstream industries such as coatings, adhesives, and resins remained weak. Many manufacturers operated below capacity or delayed raw material purchases due to uncertain order books and cautious end-user demand.

At the same time, inventories across Europe stayed comfortable. Steady imports and adequate domestic availability prevented any significant tightening of supply. Even though there were some seasonal maintenance activities at downstream units, these disruptions were not strong enough to create price support.

Market sentiment remained bearish throughout most of the quarter. Traders avoided speculative buying, and most transactions were driven by immediate needs rather than long-term commitments. Trading volumes were limited, and price negotiations favored buyers.

During September 2025, the Netherlands Methanol market showed mixed signals. Early in the month, prices saw mild gains due to temporary optimism and short-term supply uncertainties. However, this momentum did not last. As trader interest faded and commercial activity slowed, prices weakened again. Buyers continued to procure cautiously, reinforcing a fragile pricing environment and maintaining overall volatility.

Methanol Price Trend in Saudi Arabia

In contrast to Europe, the Methanol Price Trend in Saudi Arabia was relatively stable with a mild upward bias during Q3 2025. Methanol export prices from Saudi Arabia increased by approximately 1.84%, with FOB Jeddah prices ranging between USD 215 and USD 240 per metric ton.

This modest price increase was supported by consistent export demand from Asian and African markets. Saudi producers benefited from smooth plant operations, efficient port activity, and stable upstream energy costs. These factors allowed producers to maintain steady output and reliable supply schedules.

Exports to Asia played a key role in supporting prices. Continuous shipments slightly tightened regional availability, improving market sentiment. While the price gains were not aggressive, they reflected a balanced market where supply and demand remained largely aligned.

However, towards September 2025, sentiment in the Saudi Methanol market began to soften. Export demand weakened gradually, and overseas buyers reduced procurement volumes. Trading activity slowed, and buyer interest declined. As a result, prices faced steady downward pressure through the month.

This shift highlighted how dependent the Saudi Methanol market is on international demand. Even with stable production and logistics, reduced global buying appetite quickly impacted prices. The market tone became more restrained, reflecting broader challenges in global trade flows.

Methanol Price Trend in the United States

In the United States, the Methanol Price Trend during Q3 2025 remained relatively firm compared to other regions. Tight supply conditions and strong downstream demand, particularly from the MTBE sector, supported price stability. Export activity also contributed to maintaining a positive pricing environment.

Domestic production faced periodic constraints, which limited availability and prevented inventory buildup. Buyers in the fuel blending and chemical sectors continued steady procurement, helping prices remain resilient despite broader global uncertainty.

While prices did not rise sharply, the U.S. market demonstrated stability and confidence. The combination of supply discipline and consistent demand allowed Methanol prices to hold firm throughout most of the quarter.

Market Sentiment and Buyer Behavior

One of the defining features of the Methanol Price Trend in Q3 2025 was cautious buyer behavior. Across regions, buyers avoided bulk purchases unless necessary. Many preferred short-term contracts or spot buying to manage risk in an uncertain market.

Speculative activity remained limited, especially in Europe and Asia. Market participants closely monitored freight trends, downstream demand signals, and inventory levels before making procurement decisions. This cautious approach helped prevent sharp price spikes but also limited recovery in weaker markets.

Conclusion: A Moderately Volatile Quarter

The Methanol Price Trend in Q3 2025 can best be described as moderately volatile. Prices moved within a narrow range, influenced by regional demand differences, logistics, and supply conditions. Stronger markets like North America and Saudi Arabia provided balance, while softer regions such as Europe and China weighed on global sentiment.

Despite fluctuations, the market showed resilience. There were no extreme disruptions, and supply chains remained largely stable. However, the lack of strong demand growth and cautious trading behavior kept prices from gaining sustained momentum.

As the quarter ended, the Methanol market stood at a crossroads, shaped by fragile demand recovery, evolving freight dynamics, and regional supply balance. The experience of Q3 2025 reinforced the importance of close market monitoring and flexible procurement strategies in navigating the ever-changing Methanol Price Trend.

About Price Watch™ AI

Price-Watch AI is an India-based, independent raw material price reporting agency that provides real-time price forecasts and data-driven insights into global raw material markets. Price-Watch AI specializes in tracking raw material prices, analyzing market trends, and delivering timely updates on plant shutdowns, supply disruptions, capacity expansions, and demand-supply dynamics. The Price-Watch AI platform empowers manufacturers, traders, and procurement professionals to make faster, smarter decisions. Leveraging AI-powered forecasting and over a decade of historical data, Price-Watch AI transforms market volatility into actionable opportunity.

Futura Tech Park,

C Block, 8th floor 334,

Old Mahabalipuram Road,

Sholinganallur, Chennai, Tamil Nadu, Pincode - 600119.

𝐋𝐢𝐧𝐤𝐞𝐝𝐈𝐧: https://www.linkedin.com/company/price-watch-ai/

𝐅𝐚𝐜𝐞𝐛𝐨𝐨𝐤: https://www.facebook.com/people//61568490385598/

𝐓𝐰𝐢𝐭𝐭𝐞𝐫: https://x.com/pricewatchai

𝐖𝐞𝐛𝐬𝐢𝐭𝐞: https://www.price-watch.ai/

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- الألعاب

- Gardening

- Health

- الرئيسية

- Literature

- Music

- Networking

- أخرى

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness