Mixed Xylene Price Trend: A Global Market Moving with Caution in Q3 2025

The Mixed Xylene Price Trend during the third quarter of 2025 reflected a market that was stable on the surface but cautious underneath. Across major producing and exporting regions, prices moved within a narrow range as supply remained steady and demand showed mixed signals. Instead of sharp rallies or sudden drops, the market followed a slow and measured path, shaped mainly by balanced availability, careful buying behavior, and changing downstream needs.

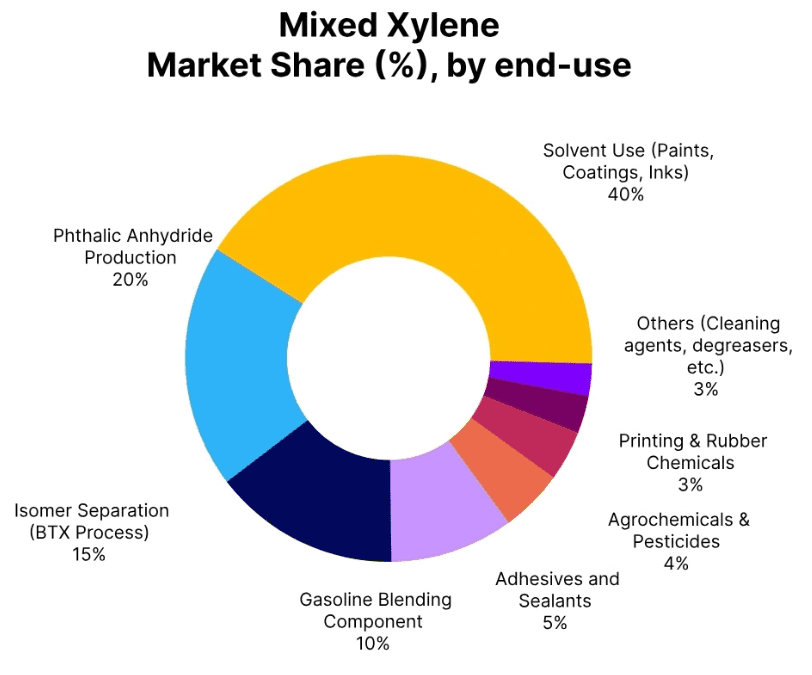

Mixed Xylene is widely used as a solvent and as a feedstock in several chemical industries. Because of this, its price movement often reflects the broader health of industrial activity, refinery operations, and trade sentiment. In Q3 2025, these factors came together to create a market that was neither overly bullish nor strongly bearish, but one that required close attention from buyers and sellers alike.

Global Overview: Balanced Supply, Careful Demand

On a global level, the Mixed Xylene Prices showed mixed direction during Q3 2025. Supply conditions were largely comfortable, supported by stable refinery operating rates and regular availability of key upstream materials such as Reformate and Toluene. There were no major production disruptions reported, which helped prevent sudden price spikes.

At the same time, demand did not show strong growth. Many downstream industries operated steadily but without urgency. Buyers generally avoided long-term commitments and focused on short-term purchasing. This “wait-and-watch” approach became a common theme across regions, especially as inventories were already sufficient in many markets.

Please Submit Your Query For Mixed Xylene Price Trend, Market Analysis and Forecast: https://www.price-watch.ai/book-a-demo/

Freight rates remained relatively stable throughout the quarter. While logistics costs always influence international trade, their impact on Mixed Xylene prices during this period was limited. As a result, price movements were driven more by local supply-demand dynamics than by transportation costs.

Overall, the global market sentiment was cautious but calm. Some regions experienced mild price gains due to localized demand support, while others saw small corrections where buying interest weakened. This resulted in a Mixed Xylene Price Trend that was uneven across countries but steady overall.

South Korea: Stable Market with Mild Upward Support

In South Korea, the Mixed Xylene Price Trend under FOB Busan terms showed resilience during Q3 2025. Prices recorded a slight increase over the quarter, supported by stable regional demand and moderate feedstock cost movements. Refinery operations remained consistent, ensuring a smooth supply of product for both domestic use and exports.

The number of market inquiries stayed steady throughout the quarter. While there was no surge in demand, there was also no significant slowdown. Export allocations were managed carefully, which helped suppliers maintain firm pricing levels without putting pressure on buyers.

However, September 2025 saw a small month-on-month decline of around 0.86% compared to August. This minor softening reflected balanced demand conditions rather than any structural weakness in the market. Feedstock availability remained sufficient, and inventories were comfortable.

Despite this monthly dip, the overall quarterly performance remained positive. Prices in South Korea were assessed in the range of USD 655 to 700 per metric ton, showing a quarter-on-quarter increase of about 1.32%. Sellers also reported healthy contract renewals toward the end of the quarter, which further supported market confidence. This made South Korea one of the more stable regions within the global Mixed Xylene Price Trend during Q3 2025.

Taiwan: Slight Pressure Amid Weak Export Interest

Taiwan’s Mixed Xylene Price Trend followed a slightly different path. During Q3 2025, prices under FOB Kaohsiung terms faced mild downward pressure. The key reason behind this movement was sluggish export activity and weaker international buying interest. Market participants reported fewer inquiries, and arbitrage opportunities remained limited.

Even though feedstock availability from nearby petrochemical hubs was steady, and production levels remained stable, demand did not pick up enough to support price increases. Sellers offered competitive prices, but buyers remained cautious and avoided aggressive procurement.

In September 2025, Mixed Xylene prices in Taiwan declined marginally by around 0.40% on a month-on-month basis. This drop was mainly due to comfortable stock levels and steady, rather than growing, demand. There was no panic selling, but there was also little incentive for buyers to push prices higher.

For the quarter as a whole, prices hovered between USD 705 and 730 per metric ton, reflecting only a small quarter-on-quarter change of about 0.80%. This showed that while prices softened slightly, the overall market remained stable. Taiwan’s Mixed Xylene Price Trend during Q3 2025 can best be described as flat to mildly negative, shaped by cautious trade sentiment.

Thailand: Steady Conditions with Limited Momentum

In Thailand, the Mixed Xylene Price Trend under FOB Laem Chabang terms remained relatively steady during Q3 2025. Market conditions were balanced, with stable supply from regional refineries and moderate demand from downstream users. Like other Asian markets, buyers in Thailand preferred short-term purchases and avoided building large inventories.

Export activity was present but not aggressive. Sellers managed volumes carefully to avoid oversupply, while buyers waited for clearer demand signals. Feedstock costs did not fluctuate significantly, which helped keep prices within a narrow range.

Although the Thai market did not experience strong price growth, it also avoided sharp declines. The absence of major disruptions, combined with stable production and cautious demand, resulted in a calm and controlled pricing environment. Thailand’s role in the broader Mixed Xylene Price Trend during this period was that of stability rather than volatility.

Market Behavior and Buyer Sentiment

One of the most noticeable features of the Mixed Xylene Price Trend in Q3 2025 was buyer behavior. Across regions, buyers showed a preference for flexibility. Instead of locking in long-term contracts at fixed prices, many opted for short-term deals that allowed them to respond quickly to market changes.

This approach was influenced by existing inventory levels and uncertainty around future demand. While there was no major economic shock, many industries remained cautious, which limited aggressive purchasing. Sellers, on the other hand, focused on maintaining steady operations and protecting margins rather than pushing for higher volumes.

Conclusion: A Market Defined by Balance

In conclusion, the Mixed Xylene Price Trend during Q3 2025 reflected a market that was balanced but careful. Stable supply, steady feedstock availability, and controlled refinery operations provided a strong foundation. However, mixed demand signals and cautious buying behavior kept price movements limited.

South Korea stood out with mild quarterly gains, Taiwan experienced slight downward pressure due to weaker exports, and Thailand maintained steady pricing with limited momentum. Together, these regional trends formed a global picture of stability without strong direction.

As the market moves beyond Q3 2025, participants are likely to continue monitoring demand recovery, inventory levels, and upstream cost movements. Until clearer signals emerge, the Mixed Xylene market is expected to remain calm, with price trends shaped more by balance than by extremes.

About Price Watch™ AI

Price-Watch AI is an India-based, independent raw material price reporting agency that provides real-time price forecasts and data-driven insights into global raw material markets. Price-Watch AI specializes in tracking raw material prices, analyzing market trends, and delivering timely updates on plant shutdowns, supply disruptions, capacity expansions, and demand-supply dynamics. The Price-Watch AI platform empowers manufacturers, traders, and procurement professionals to make faster, smarter decisions. Leveraging AI-powered forecasting and over a decade of historical data, Price-Watch AI transforms market volatility into actionable opportunity.

Futura Tech Park,

C Block, 8th floor 334,

Old Mahabalipuram Road,

Sholinganallur, Chennai, Tamil Nadu, Pincode - 600119.

𝐋𝐢𝐧𝐤𝐞𝐝𝐈𝐧: https://www.linkedin.com/company/price-watch-ai/

𝐅𝐚𝐜𝐞𝐛𝐨𝐨𝐤: https://www.facebook.com/people//61568490385598/

𝐓𝐰𝐢𝐭𝐭𝐞𝐫: https://x.com/pricewatchai

𝐖𝐞𝐛𝐬𝐢𝐭𝐞: https://www.price-watch.ai/

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- الألعاب

- Gardening

- Health

- الرئيسية

- Literature

- Music

- Networking

- أخرى

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness