-

Noticias Feed

- EXPLORE

-

Páginas

-

Grupos

-

Eventos

-

Blogs

-

Marketplace

-

Foros

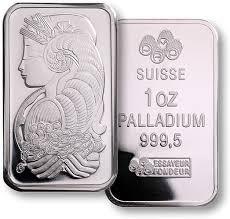

Palladium Prices: A Simple Look at a Precious Metal with Industrial Power

Palladium prices refer to the cost of palladium per ounce, gram, or kilogram in global markets. Palladium is a rare and valuable metal that has both industrial uses and investment demand. Unlike gold or silver, palladium’s price movements are strongly tied to its use in technology, especially in automobile catalytic converters, which reduce harmful emissions. Because of this mix of practical industrial demand and limited supply, palladium prices often show distinctive trends that reflect broader economic and environmental patterns.

👉 👉 👉 Please Submit Your Query for Alumina Premium Price Trend, demand-supply, suppliers, market analysis: https://www.price-watch.ai/book-a-demo/

What Palladium Is and Why It Matters

Palladium is a member of the platinum group metals (PGMs), known for its ability to withstand high temperatures and resist corrosion. Its most important use is in catalytic converters — devices installed in cars that help convert toxic gases from exhaust into less harmful substances. As global automotive production grows and environmental standards become stricter, more palladium is needed to meet emissions targets.

Palladium also finds use in electronics, dentistry, jewelry, and some chemical processes. However, the majority of demand comes from the automotive sector, making palladium prices particularly sensitive to trends in vehicle production and environmental policy.

Key Drivers of Palladium Prices

One of the strongest drivers of palladium prices is automobile demand. When car production expands, especially in regions with strict emissions regulations like Europe and North America, demand for catalytic converters rises and supports higher palladium prices. Conversely, when auto manufacturing slows, palladium demand — and often prices — can ease.

Global supply is another major factor. Palladium is produced in limited quantities, with just a few countries accounting for the bulk of global output. Any disruption in mining, processing, or exports — whether due to geopolitical events, labor issues, or regulatory changes — can tighten supply and push prices higher.

Environmental Regulations and Price Trends

Environmental standards, such as those limiting vehicle emissions, have a direct impact on palladium prices. Stricter regulations typically increase demand for catalytic converters, which in turn raises palladium consumption. This has been one important reason why palladium prices have remained high in certain periods, as governments push for cleaner air and lower emissions.

Changes in policy, such as shifts toward electric vehicles, can also influence prices. Electric vehicles generally use less or no palladium in their powertrains, which may reduce future demand, but this shift is gradual and does not immediately eliminate palladium’s role in internal combustion vehicles.

Global Market Influence

Palladium prices are set in global commodity markets and are influenced by international demand and supply dynamics. Traders, manufacturers, jewelers, and investors all participate in pricing, and exchange rates can affect how palladium prices appear in local markets.

Because palladium is traded internationally, factors like shipping costs, tariffs, currency fluctuations, and trade relations can subtly shift prices from one region to another.

Short-Term Price Movements

In the short term, palladium prices can react strongly to news that affects supply or demand. For example, reports of mine shutdowns, changes in auto production forecasts, or shifts in investor sentiment can move prices up or down quickly. These short-term movements reflect the metal’s sensitivity to real-world events and expectations about future use.

Long-Term Trends and Industrial Demand

Over the longer term, palladium prices reflect fundamental trends in industrial growth, technology adoption, and environmental regulation. Since palladium’s largest use is in catalytic converters, its price trend often parallels trends in transportation and regulatory policy. As emission standards continue to evolve and more countries adopt cleaner technologies, demand for palladium remains closely watched by industry analysts.

Investment and Speculative Interest

Although palladium’s primary demand is industrial, it also attracts investment and speculative interest. Some investors buy palladium as a store of value or as a hedge against inflation and currency weakness, similar to other precious metals. This investment demand can add an additional layer of influence on prices, especially during periods of economic uncertainty.

Everyday Connection to Palladium Prices

Most people encounter palladium indirectly through products that benefit from its use. Vehicles with catalytic converters help reduce air pollution, and many electronics incorporate palladium in small amounts. While consumers rarely see palladium in its raw form, its presence impacts quality, performance, and environmental outcomes.

Conclusion

Palladium prices are shaped by real industrial demand, especially from the automotive sector, limited global supply, environmental regulations, and broader economic trends. Short-term price swings may reflect news and market sentiment, but long-term movements closely follow patterns in manufacturing, environmental policy, and technology adoption. As the world continues to balance environmental goals with industrial needs, palladium remains an important and closely watched metal with a meaningful price trend in global markets.

About Price Watch™ AI

Price-Watch AI is an India-based, independent raw material price reporting agency that provides real-time price forecasts and data-driven insights into global raw material markets. Price-Watch AI specializes in tracking raw material prices, analyzing market trends, and delivering timely updates on plant shutdowns, supply disruptions, capacity expansions, and demand-supply dynamics. The Price-Watch AI platform empowers manufacturers, traders, and procurement professionals to make faster, smarter decisions. Leveraging AI-powered forecasting and over a decade of historical data, Price-Watch AI transforms market volatility into actionable opportunity.

Futura Tech Park,

C Block, 8th floor 334,

Old Mahabalipuram Road,

Sholinganallur, Chennai, Tamil Nadu, Pincode - 600119.

LinkedIn: https://www.linkedin.com/company/price-watch-ai/

Facebook: https://www.facebook.com/people/Price-Watch/61568490385598/

Twitter: https://x.com/pricewatchai

Website: https://www.price-watch.ai/

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Juegos

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness