-

Feed de Notícias

- EXPLORAR

-

Páginas

-

Grupos

-

Eventos

-

Blogs

-

Marketplace

-

Fóruns

Orthoxylene Price Trend: A Detailed Look at Global Market Movement in Q3 2025

The Orthoxylene Price Trend during the third quarter of 2025 reflected a period of sustained weakness across global markets. Prices moved steadily downward in most major regions, shaped by a combination of soft demand, balanced to ample supply, and cautious buying behaviour from downstream industries. While raw material costs stayed largely stable, the overall market lacked the momentum needed to support prices, resulting in a clearly bearish trend.

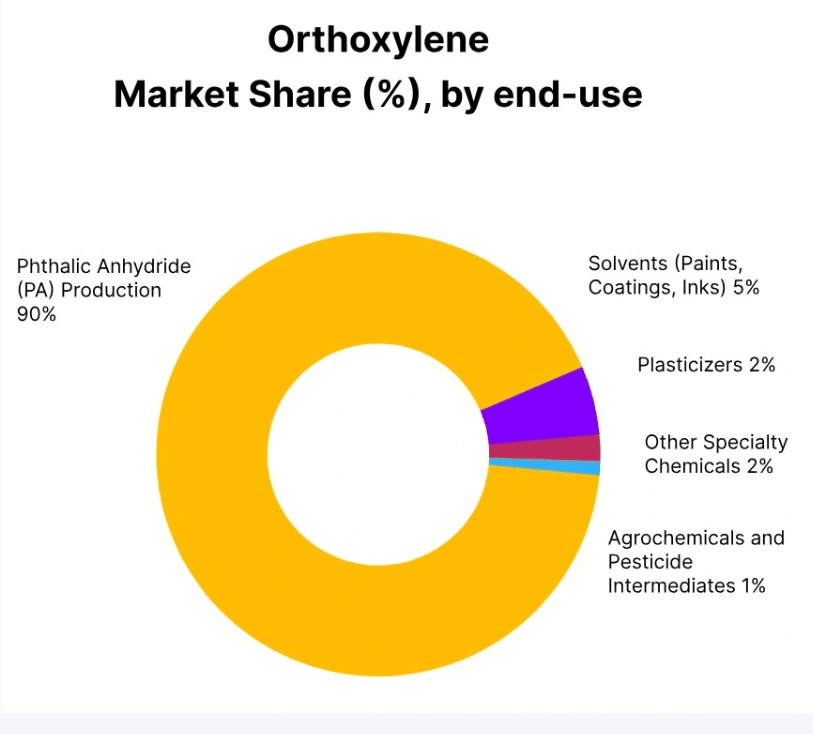

Orthoxylene is widely used as a key raw material in the production of phthalic anhydride, which further feeds into plasticizers, resins, coatings, and construction-related products. Because of this strong link to industrial activity, Orthoxylene prices tend to move in line with broader manufacturing and chemical sector demand. In Q3 2025, that demand remained subdued, putting consistent pressure on prices across Asia, North America, and Europe.

Global Market Overview

On a global level, the Orthoxylene Prices market experienced oversupply in several regions. Production rates remained stable, supported by steady availability of feedstocks such as Reformate and Toluene. However, consumption did not grow at the same pace. Many buyers operated with sufficient inventories and preferred short-term or hand-to-mouth purchasing instead of building long positions.

This mismatch between supply and demand played a major role in shaping the Orthoxylene Price Trend. Sellers faced increasing competition, especially in export markets, and were often forced to revise offers downward to attract buyers. Spot market activity remained limited, with fewer inquiries and slow deal closures throughout the quarter.

Please Submit Your Query For Orthoxylene Price Trend, Market Analysis and Forecast: https://www.price-watch.ai/book-a-demo/

Freight costs also influenced market dynamics, particularly for import-dependent regions. While freight fluctuations did not spike sharply, even minor changes in logistics costs affected landed prices and buying decisions. Overall, cautious trade sentiment and conservative procurement strategies dominated the market environment.

Orthoxylene Price Trend in South Korea

South Korea was one of the regions that saw a sharper decline in Orthoxylene prices during Q3 2025. Export prices under FOB Busan terms fell significantly as regional buying interest weakened and product availability increased. Domestic producers continued to operate at steady rates, but export demand failed to absorb the available volumes.

Buyers across Asia showed limited appetite for long-term commitments, preferring to wait for further price corrections. As a result, spot inquiries remained thin. Even though feedstock availability for Xylene production remained stable, downstream demand was too weak to provide any price support.

The Orthoxylene Price Trend in South Korea clearly moved downward, with prices assessed in the range of USD 795–885 per metric ton. This represented a quarterly decline of around 9.15%. September 2025 saw an additional month-on-month drop of approximately 4.25%, highlighting the continued bearish momentum. Exporters adjusted offers aggressively to stay competitive against alternative supply sources in the region.

Orthoxylene Price Trend in the United States

In the United States, the Orthoxylene Price Trend also pointed downward, although the decline was more moderate compared to parts of Asia. Export prices under FOB Houston terms edged lower due to cautious purchasing behaviour and sufficient domestic supply.

US producers reported stable operating rates throughout the quarter, but demand from downstream sectors such as plasticizers and phthalic anhydride remained weak. Construction and industrial activity showed little improvement, which limited consumption growth. Trading activity was relatively muted, and most deals were concluded at competitive levels to stimulate buyer interest.

Despite steady feedstock costs, market sentiment remained bearish. Prices ranged between USD 900–970 per metric ton during Q3 2025, reflecting a quarterly decline of around 3.23%. In September 2025, prices dropped further by about 4.57% month-on-month. US exporters reduced margins to remain competitive in global markets, especially as international supply conditions stayed balanced.

Orthoxylene Price Trend in Singapore

Singapore also experienced a notable decline in Orthoxylene prices during Q3 2025. As a key regional trading hub, Singapore’s market was heavily influenced by weak spot demand and ample supply availability across Southeast Asia.

Local suppliers faced growing pressure as interest from regional buyers declined. Export activity remained limited, and many buyers delayed purchases due to expectations of further price drops. Although feedstock input costs remained relatively stable, negotiations consistently leaned toward lower price levels.

The Orthoxylene Price Trend in Singapore remained on a downward slope throughout the quarter. Prices were assessed between USD 810–888 per metric ton, marking a decline of approximately 6.71% from Q2 2025. In September 2025, prices fell by another 3.89% compared to the previous month. Exporters reduced offers to manage inventory levels and respond to softer regional demand.

Orthoxylene Price Trend in the Netherlands and Europe

In Europe, including the Netherlands, the Orthoxylene market followed the same bearish pattern seen globally. Demand from downstream industries such as coatings, resins, and plasticizers remained weak, while supply stayed sufficient due to steady production and regular import arrivals.

Buyers in the Netherlands focused mainly on contractual volumes and avoided spot purchases unless prices were particularly attractive. Inventories across Northwest Europe were balanced to ample, reducing urgency among buyers. Additionally, competitive offers from alternative origins added pressure on local sellers.

The Orthoxylene Price Trend in the Netherlands reflected this weak market environment. Prices moved lower during Q3 2025, declining by an estimated 4–5% compared to the previous quarter. September saw further easing, as soft consumption and cautious trade behaviour continued to limit any recovery.

Key Factors Influencing the Orthoxylene Price Trend

Several common factors shaped the Orthoxylene Price Trend across regions in Q3 2025:

- Subdued downstream demand: Weak performance in construction, automotive, and manufacturing sectors reduced consumption of phthalic anhydride and related products.

- Stable feedstock costs: While feedstock prices did not rise sharply, they also did not provide enough upward pressure to support Orthoxylene prices.

- Oversupply conditions: Steady production rates combined with limited demand led to higher inventories in many regions.

- Cautious buying behaviour: Buyers preferred short-term purchasing and avoided stock-building amid uncertain market outlooks.

- Export competition: Global suppliers competed aggressively, often lowering offers to secure limited demand.

Market Outlook

Looking ahead, the Orthoxylene Price Trend will continue to depend heavily on downstream demand recovery. Any improvement in construction activity, infrastructure spending, or industrial output could help stabilize prices. However, if supply remains steady and demand stays weak, prices may continue to face pressure.

Market participants are expected to remain cautious in the near term, closely monitoring inventory levels, feedstock movements, and global economic signals. Until a clear demand-side recovery emerges, the Orthoxylene market is likely to maintain a conservative and price-sensitive trading environment.

Conclusion

In summary, the Orthoxylene Price Trend in Q3 2025 was characterized by consistent downward movement across major global markets. From South Korea and Singapore to the USA and the Netherlands, prices declined due to subdued demand, ample supply, and cautious trade sentiment. Despite stable feedstock availability, the lack of strong downstream consumption kept the market firmly bearish. As the industry moves forward, demand recovery will remain the key factor in determining whether Orthoxylene prices can regain stability or continue their downward path.

About Price Watch™ AI

Price-Watch AI is an India-based, independent raw material price reporting agency that provides real-time price forecasts and data-driven insights into global raw material markets. Price-Watch AI specializes in tracking raw material prices, analyzing market trends, and delivering timely updates on plant shutdowns, supply disruptions, capacity expansions, and demand-supply dynamics. The Price-Watch AI platform empowers manufacturers, traders, and procurement professionals to make faster, smarter decisions. Leveraging AI-powered forecasting and over a decade of historical data, Price-Watch AI transforms market volatility into actionable opportunity.

Futura Tech Park,

C Block, 8th floor 334,

Old Mahabalipuram Road,

Sholinganallur, Chennai, Tamil Nadu, Pincode - 600119.

𝐋𝐢𝐧𝐤𝐞𝐝𝐈𝐧: https://www.linkedin.com/company/price-watch-ai/

𝐅𝐚𝐜𝐞𝐛𝐨𝐨𝐤: https://www.facebook.com/people//61568490385598/

𝐓𝐰𝐢𝐭𝐭𝐞𝐫: https://x.com/pricewatchai

𝐖𝐞𝐛𝐬𝐢𝐭𝐞: https://www.price-watch.ai/

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness