-

Feed de notícias

- EXPLORAR

-

Páginas

-

Grupos

-

Eventos

-

Blogs

-

Marketplace

-

Fóruns

Paraxylene Price Trend: A Simple Overview of Q3 2025 Market Movements

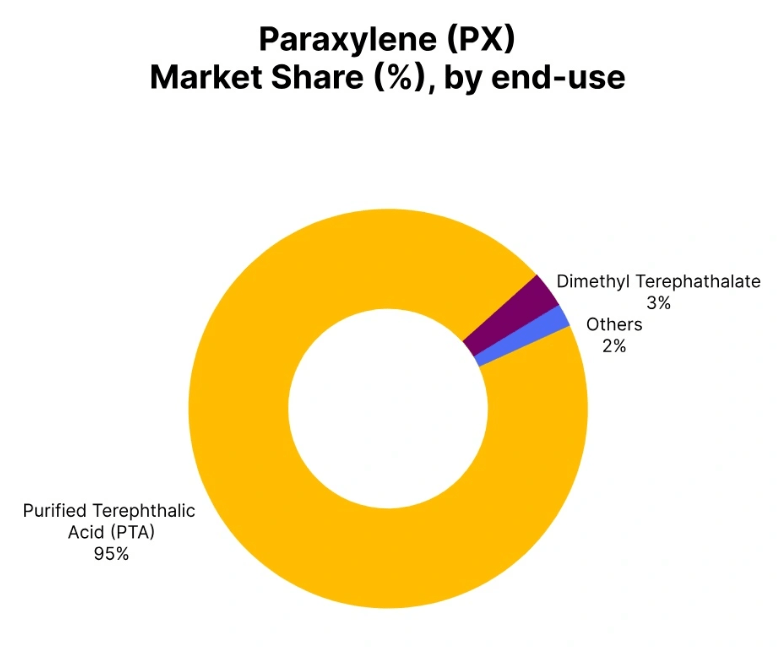

The Paraxylene Price Trend in Q3 2025 reflected a mixed but well-balanced global market, shaped by regional demand patterns, stable feedstock availability, and cautious buying behavior across key consuming industries. Paraxylene, commonly known as PX, plays a crucial role in the production of polyester, PTA, and PET products, which are widely used in textiles, packaging, and consumer goods. Because of this, its pricing often moves closely with industrial activity and downstream manufacturing demand.

During the third quarter of 2025, the global Paraxylene market showed varied price movements across major regions such as South Korea, Singapore, Saudi Arabia, and the United States. While some markets experienced steady gains supported by strong demand, others faced downward pressure due to high inventories and slower buying interest. Overall, the quarter highlighted how regional fundamentals continue to influence the Paraxylene Price Trend rather than a single global direction.

South Korea: Strong Demand Supports Prices

In South Korea, the Paraxylene Prices remained mostly positive during Q3 2025. Prices moved upward as a result of stable refinery operations and healthy demand from the polyester and PET manufacturing sectors. South Korea is a major producer and exporter of Paraxylene, and consistent plant operations helped maintain smooth supply conditions throughout the quarter.

Buyers in the domestic market showed improved confidence, which encouraged stronger procurement activity. Even though competition from other Asian suppliers remained present, South Korean producers benefited from reliable demand and steady production margins. As a result, Paraxylene prices in the country ranged between USD 790 and USD 840 per metric ton, marking a 4.28% increase over the quarter.

Please Submit Your Query For Paraxylene Price Trend, Market Analysis and Forecast: https://www.price-watch.ai/book-a-demo/

However, toward the end of the quarter, market conditions softened slightly. In September 2025, prices declined by 1.35%, mainly due to slower demand from downstream PTA and PET producers. Stable inventory levels also limited further price increases. Despite this short-term dip, the overall market sentiment in South Korea remained cautiously optimistic, supported by balanced supply and demand fundamentals.

Singapore: Bearish Sentiment Due to High Inventory

In contrast to South Korea, the Paraxylene Price Trend in Singapore showed a downward movement during Q3 2025. Singapore acts as a major trading and export hub in Southeast Asia, and price trends there are heavily influenced by regional demand conditions and inventory levels.

Throughout the quarter, Paraxylene prices in Singapore declined as buying interest from polyester manufacturers weakened. Plentiful stock levels across the region reduced the urgency among buyers, which placed suppliers under pressure during price negotiations. Export activity also slowed, contributing to a generally bearish market mood.

Paraxylene export prices FOB Singapore ranged between USD 825 and USD 900 per metric ton, reflecting a 6.15% decline over the quarter. Market participants adopted a cautious approach, purchasing only what was immediately required rather than building inventories.

In September 2025, prices dropped further by 2.46%, driven by subdued regional demand and slightly softer feedstock costs. The near-term outlook in Singapore depends largely on how quickly downstream demand recovers and whether producers adjust output to better match market needs.

Saudi Arabia: Stable Supply, Limited Export Momentum

The Paraxylene Price Trend in Saudi Arabia during Q3 2025 remained relatively stable with a slight downward bias. The country continued to maintain steady domestic production levels, which ensured sufficient supply in the local and export markets. However, demand from key importing regions, particularly Asia and North Africa, remained moderate.

Limited export momentum capped any potential price gains, as buyers showed restraint amid adequate availability from other global suppliers. As a result, Paraxylene prices in Saudi Arabia ranged between USD 765 and USD 815 per metric ton, reflecting a 0.71% decrease during the quarter.

Market sentiment in the region leaned toward stability rather than sharp movement. In September 2025, prices fell by 2.52%, influenced by moderate demand from polyester and PET producers and increased competition from Asian exporters. Looking ahead, industry participants expect prices to remain mostly stable unless there is a noticeable change in downstream consumption or export demand.

United States: Balanced Market Conditions

In the United States, the Paraxylene Price Trend during Q3 2025 was shaped by balanced supply and demand conditions. Domestic production remained steady, and feedstock availability did not present any major challenges. Export prices FOB Houston reflected cautious optimism, as buyers maintained regular purchasing patterns without aggressive stockpiling.

The U.S. market benefited from stable refinery operations and predictable demand from domestic PTA and PET manufacturers. However, global competition and freight considerations limited significant price increases. While the U.S. did not experience sharp price swings during the quarter, the market maintained a firm undertone supported by consistent industrial activity.

Key Factors Influencing the Paraxylene Price Trend

Several common factors influenced the Paraxylene Price Trend across regions in Q3 2025:

- Downstream Demand: Polyester, PTA, and PET demand played a central role in shaping prices. Regions with stronger downstream activity saw better price support.

- Inventory Levels: High stock availability, especially in trading hubs like Singapore, weighed heavily on prices.

- Feedstock Stability: Stable feedstock costs helped prevent extreme price volatility across most markets.

- Export Competition: Increased competition among exporters, particularly from Asia, limited price growth in regions like Saudi Arabia.

- Buyer Sentiment: A cautious buying approach was seen globally, with many buyers preferring short-term purchases.

Overall Market Outlook

The overall Paraxylene Price Trend in Q3 2025 highlighted a market that is largely stable but sensitive to regional demand shifts. While some areas benefited from strong industrial consumption, others struggled with oversupply and weak buying interest. The quarter ended with a cautiously optimistic outlook, as most markets maintained balanced supply-demand conditions.

Going forward, Paraxylene prices are expected to move in line with downstream recovery, production adjustments, and broader economic conditions. Any significant change in polyester or PET demand could quickly influence market direction. For now, the Paraxylene market remains steady, practical, and driven more by fundamentals than speculation.

About Price Watch™ AI

Price-Watch AI is an India-based, independent raw material price reporting agency that provides real-time price forecasts and data-driven insights into global raw material markets. Price-Watch AI specializes in tracking raw material prices, analyzing market trends, and delivering timely updates on plant shutdowns, supply disruptions, capacity expansions, and demand-supply dynamics. The Price-Watch AI platform empowers manufacturers, traders, and procurement professionals to make faster, smarter decisions.Leveraging AI-powered forecasting and over a decade of historical data, Price-Watch AI transforms market volatility into actionable opportunity.

Futura Tech Park,

C Block, 8th floor 334,

Old Mahabalipuram Road,

Sholinganallur, Chennai, Tamil Nadu, Pincode - 600119.

𝐋𝐢𝐧𝐤𝐞𝐝𝐈𝐧: https://www.linkedin.com/company/price-watch-ai/

𝐅𝐚𝐜𝐞𝐛𝐨𝐨𝐤: https://www.facebook.com/people//61568490385598/

𝐓𝐰𝐢𝐭𝐭𝐞𝐫: https://x.com/pricewatchai

𝐖𝐞𝐛𝐬𝐢𝐭𝐞: https://www.price-watch.ai/

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness