-

Ροή Δημοσιεύσεων

- ΑΝΑΚΆΛΥΨΕ

-

Σελίδες

-

Ομάδες

-

Events

-

Blogs

-

Marketplace

-

Forum

Petroleum Coke Price Trend: A Simple Look at the Global Market

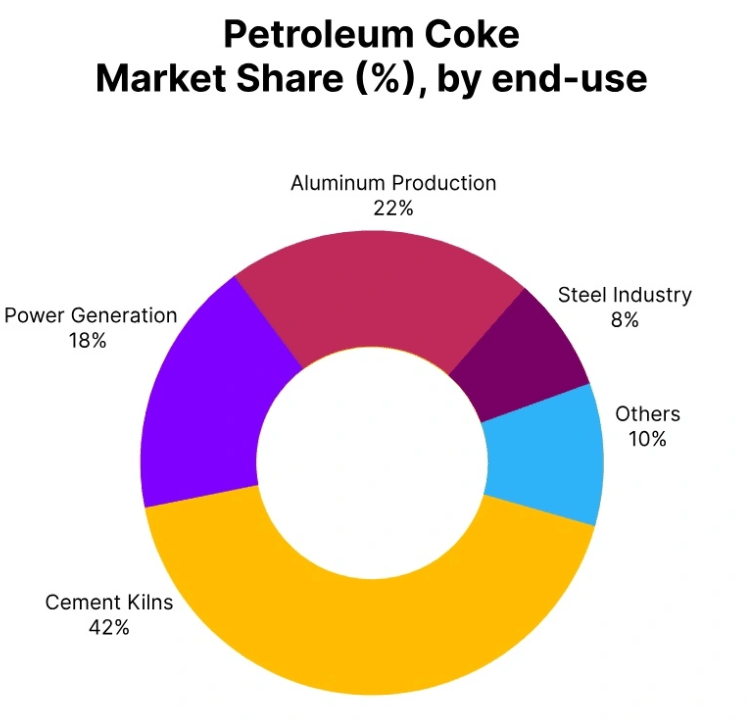

The Petroleum Coke Price Trend has drawn growing attention from industries across the world, especially those linked to cement, power generation, aluminum, steel, and other energy-intensive sectors. Petroleum coke, commonly known as pet coke, is a solid carbon material derived from oil refining. Because it is closely linked to crude oil refining and industrial fuel demand, its prices often move in response to broader economic and industrial conditions.

In Q3 2025, the global petroleum coke market showed a mostly bearish tone. Prices declined in many regions as supply remained ample while demand stayed moderate. This situation created a cautious market environment, where buyers avoided aggressive purchases and suppliers adjusted prices to stay competitive.

Overall Market Situation in Q3 2025

During Q3 2025, the Petroleum Coke Prices across the globe remained soft. Major exporting countries such as the United States and China lowered their FOB prices due to reduced international enquiries and high inventory levels. Refiners continued producing pet coke at steady rates, but global consumption growth did not match supply levels.

Many import-dependent regions, including Asia-Pacific, Latin America, and the Middle East, reported limited buying interest. Even though freight rates remained mostly stable, buyers showed hesitation due to uncertain economic conditions and sufficient stock availability. As a result, most transactions were limited to short-term or contract-based volumes.

Please Submit Your Query For Petroleum Coke Price Trend, Market Analysis and Forecast: https://www.price-watch.ai/book-a-demo/

A few regions, such as Australia and the UAE, did see marginal price increases. However, these were isolated cases driven by local demand or supply conditions and did not change the overall global trend. On a broader scale, the Petroleum Coke Price Trend continued to lean toward the bearish side.

China: Export Market Performance

China is one of the key exporters in the global petroleum coke market, and its pricing trends play an important role in shaping regional sentiment. In Q3 2025, petroleum coke prices from FOB China declined by around 3.66%. Export offers generally ranged between USD 278 and USD 306 per metric ton for non-calcined grades.

The Petroleum Coke Price Trend in China remained subdued mainly due to weaker overseas demand and sufficient domestic supply. Many international buyers reduced procurement volumes as they had access to alternative supplies from countries like India and South Korea. To stay competitive, Chinese exporters made slight downward adjustments to their offers.

Despite this overall decline, September 2025 showed a small recovery in prices, with an increase of around 0.67%. This mild improvement was supported by steady export shipments and slight gains in downstream usage rates. Refinery operations in China continued smoothly, ensuring stable feedstock availability.

However, market sentiment remained cautious. Sellers avoided aggressive price hikes, as global demand growth was still calculated and controlled. Expectations for Q4 were conservative, with most participants anticipating continued pressure on prices.

USA: Export Market Conditions

The United States remained another major supplier in the global pet coke market, especially for high-sulphur grades. In Q3 2025, petroleum coke prices from FOB USA saw a sharper decline of about 8.57%, with prices ranging between USD 67 and USD 77 per metric ton.

The Petroleum Coke Price Trend in the USA stayed clearly bearish. One of the main reasons was weak international demand, particularly from Asia and Latin America. At the same time, inventories of high-sulphur petroleum coke continued to build up, putting additional pressure on prices.

US exporters also faced strong competition from suppliers in the Gulf region and South America. These suppliers offered comparable material, which reduced net returns for American refiners. To maintain export volumes, sellers had little choice but to lower prices.

In September 2025, prices dropped further by around 5.63%. Oversupply conditions persisted, and buying activity remained limited. Although refiners maintained steady production levels, downstream consumption did not show meaningful improvement. Freight stability helped maintain shipment flows, but it was not enough to reverse the overall weak market tone.

India: Domestic Market Perspective

India is one of the largest consumers of petroleum coke, particularly for cement and industrial fuel applications. Unlike China and the USA, India’s pet coke market is more focused on domestic trade, with prices influenced by local refinery output, industrial demand, and regulatory factors.

During Q3 2025, domestic petroleum coke prices in India, especially ex-Jamnagar for non-calcined Grade A material, reflected cautious market behavior. Buyers remained conservative, purchasing mainly based on immediate needs rather than future expectations.

The Petroleum Coke Price Trend in India was shaped by steady domestic supply and moderate demand from end-use sectors. Cement manufacturers and other industrial users operated at controlled production levels, which limited any strong upward movement in prices.

Demand-Side Factors Affecting Prices

One of the key reasons behind the soft Petroleum Coke Price Trend in Q3 2025 was moderate demand across major consuming industries. Cement production, power generation, and metal processing sectors showed stable but unspectacular performance.

Many industrial buyers focused on cost control and inventory management. Instead of stockpiling petroleum coke, they preferred shorter procurement cycles. This buying behavior reduced market liquidity and limited price recovery.

Environmental regulations and fuel substitution also played a role. In some regions, industries explored alternative fuels or optimized fuel mixes, which reduced dependence on petroleum coke and added pressure on demand.

Supply Conditions and Market Balance

On the supply side, petroleum coke availability remained comfortable throughout the quarter. Refiners continued operating at stable rates, supported by consistent crude oil processing. There were no major supply disruptions reported in key producing regions.

High inventory levels, particularly in export markets, weighed heavily on prices. Sellers focused on clearing stocks rather than pushing for higher margins. This supply-heavy situation kept the Petroleum Coke Price Trend under pressure despite stable logistics and freight conditions.

Market Outlook

Looking ahead, the petroleum coke market is expected to remain cautious in the near term. While demand may see gradual improvement in some regions, overall consumption growth is likely to remain controlled. Supply is expected to stay adequate, which may prevent sharp price increases.

The Petroleum Coke Price Trend will continue to depend on industrial activity, energy demand, and global economic signals. Any strong recovery in construction, infrastructure, or manufacturing could provide some support to prices. However, until demand clearly outpaces supply, the market is likely to remain balanced to soft.

Conclusion

In summary, the Petroleum Coke Price Trend in Q3 2025 reflected a market dominated by ample supply, moderate demand, and cautious buying sentiment. Major exporters like China and the USA lowered prices to stay competitive, while import-dependent regions showed limited purchasing interest.

Although some localized price increases were observed, the global trend remained soft. Market participants focused on stability rather than expansion, and this practical, experience-based approach shaped price movements throughout the quarter.

Petroleum coke remains an important industrial fuel and raw material, but its pricing continues to mirror real-world industrial demand rather than speculation. As global economic conditions evolve, the market will likely adjust gradually, keeping price movements steady and measured rather than volatile.

About Price Watch™ AI

Price-Watch AI is an India-based, independent raw material price reporting agency that provides real-time price forecasts and data-driven insights into global raw material markets. Price-Watch AI specializes in tracking raw material prices, analyzing market trends, and delivering timely updates on plant shutdowns, supply disruptions, capacity expansions, and demand-supply dynamics. The Price-Watch AI platform empowers manufacturers, traders, and procurement professionals to make faster, smarter decisions. Leveraging AI-powered forecasting and over a decade of historical data, Price-Watch AI transforms market volatility into actionable opportunity.

Futura Tech Park,

C Block, 8th floor 334,

Old Mahabalipuram Road,

Sholinganallur, Chennai, Tamil Nadu, Pincode - 600119.

𝐋𝐢𝐧𝐤𝐞𝐝𝐈𝐧: https://www.linkedin.com/company/price-watch-ai/

𝐅𝐚𝐜𝐞𝐛𝐨𝐨𝐤: https://www.facebook.com/people//61568490385598/

𝐓𝐰𝐢𝐭𝐭𝐞𝐫: https://x.com/pricewatchai

𝐖𝐞𝐛𝐬𝐢𝐭𝐞: https://www.price-watch.ai/

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Παιχνίδια

- Gardening

- Health

- Κεντρική Σελίδα

- Literature

- Music

- Networking

- άλλο

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness