-

Feed de Notícias

- EXPLORAR

-

Páginas

-

Grupos

-

Eventos

-

Blogs

-

Marketplace

-

Fóruns

Propylene Price Trend in Q3 2025: A Calm but Cautious Global Market

The Propylene Price Trend during the third quarter of 2025 showed a mixed picture across global markets. Prices did not move sharply in one single direction everywhere. Instead, they reflected regional demand conditions, supply balance, downstream performance, and local buying behavior. For most regions, Q3 2025 was a period of caution rather than confidence, with buyers staying conservative and sellers adjusting expectations.

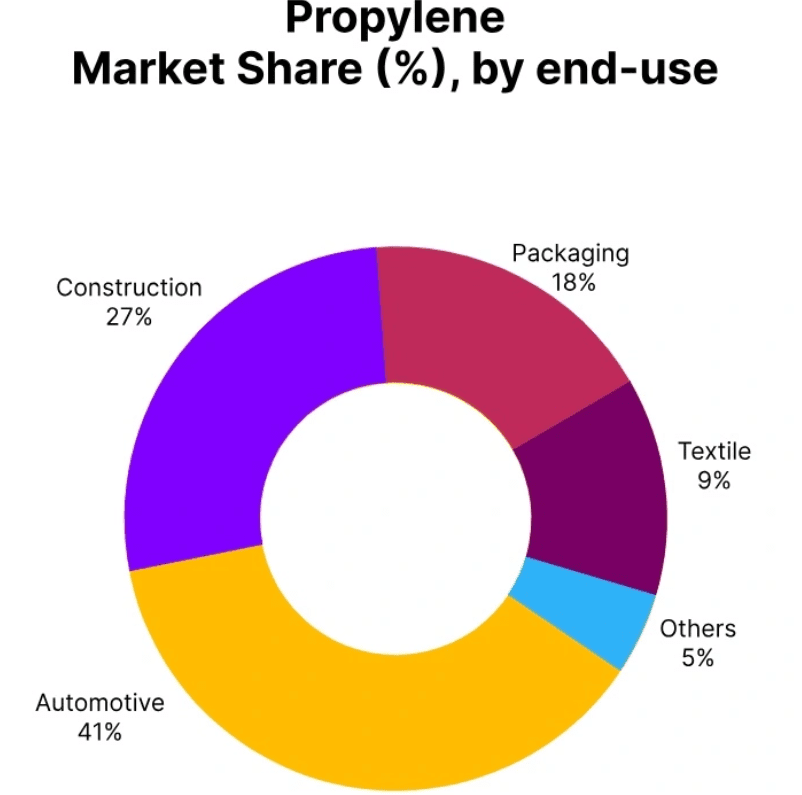

Propylene is an important building block for many everyday products, especially plastics, packaging materials, automotive components, and industrial chemicals. Because of this, its pricing closely follows the health of manufacturing and consumer demand. In Q3 2025, global economic uncertainty, weak industrial activity, and cautious purchasing patterns kept propylene prices under pressure in many markets.

Global Overview of the Propylene Price Trend

Across the world, the Propylene Prices in Q3 2025 remained mostly soft. Western markets, particularly in Europe, saw noticeable price declines. Countries such as Germany, Belgium, and the Netherlands experienced weaker demand from key industries like automotive manufacturing, construction, and packaging. These industries traditionally consume large volumes of propylene-based products, so any slowdown directly affects demand.

European producers continued running their plants at steady levels, even though industrial activity remained weak. This created an oversupply situation in several parts of the region. At the same time, high energy costs limited production flexibility, making it difficult for producers to reduce output quickly. As a result, buyers had plenty of material available and felt no urgency to purchase aggressively, which pushed prices lower.

Please Submit Your Query For Propylene Price Trend, Market Analysis and Forecast: https://www.price-watch.ai/book-a-demo/

In the Asia-Pacific region, the situation was similar but driven by slightly different factors. Markets such as South Korea and India faced downward pressure mainly due to weak downstream demand and increased competition among suppliers. Freight costs also played a role, especially for export-oriented countries, adding to overall pricing pressure.

North America also saw moderate weakness in the Propylene Price Trend. While supply remained abundant, export demand was softer than expected. Domestic markets showed signs of saturation, meaning supply was more than enough to meet demand. However, toward the end of the quarter, some upward pressure started appearing in regions like Texas and the Gulf Coast, mainly due to local market dynamics.

Overall, Q3 2025 was marked by balanced feedstock availability, moderate freight movements, and regional demand variations. Prices were not collapsing, but they were also not gaining strong support. The market remained steady but cautious.

Europe: Weak Demand Shapes the Market

In Europe, the Propylene Price Trend was largely downward during Q3 2025. Weak industrial activity was the main reason. Automotive production slowed, construction activity remained muted, and packaging demand did not show strong growth. All these sectors are major consumers of propylene derivatives.

Even though demand was weak, producers maintained stable output levels. This resulted in sufficient, and in some cases excess, supply in the market. Buyers were comfortable delaying purchases, knowing that availability was not an issue. This cautious buying behavior prevented prices from recovering during the quarter.

Energy prices also remained relatively high in Europe, which added pressure on producers’ margins. However, instead of cutting output significantly, many producers chose to keep plants running to manage fixed costs. This further contributed to oversupply and kept the Propylene Price Trend under pressure.

Asia-Pacific: Competitive and Demand-Driven

In Asia-Pacific, the Propylene Price Trend showed mild weakness across major markets such as South Korea and India. Downstream industries like polypropylene and acrylonitrile did not perform strongly, limiting propylene consumption. Buyers were focused on short-term needs rather than long-term stock building.

Competition among regional suppliers increased, especially as export markets remained sluggish. Freight costs, while not extremely high, still influenced CIF prices and reduced buying interest from importers. As a result, suppliers were forced to adjust prices to remain competitive.

India also saw similar conditions, with demand from plastic processing units remaining moderate. Seasonal factors and cautious industrial sentiment kept buyers from making aggressive purchases. Overall, Asia-Pacific markets moved in line with global trends, showing stability but no strong upward momentum.

South Korea: A Closer Look at Export Prices

South Korea provides a clear example of how the Propylene Price Trend behaved in Q3 2025. Export prices for polymer-grade propylene FOB Busan ranged between USD 730 and USD 770 per metric ton during the quarter. This represented a modest quarterly decline of around 1.22%, reflecting the balanced yet cautious market conditions.

Cracker run rates in South Korea remained stable, with no major shutdowns or disruptions. This ensured steady supply throughout the quarter. However, demand from downstream industries such as polypropylene and acrylonitrile remained only moderate, limiting price support.

In September 2025, prices dropped by around 2.95% compared to the previous month. This decline was mainly driven by cautious buying behavior and weak polymer demand across Northeast Asia. Buyers from China and Southeast Asia were selective, purchasing only when necessary and avoiding large volumes.

Feedstock costs, especially naphtha, did not show strong directional movement, which meant there was no major cost-push pressure on propylene prices. As a result, the Propylene Price Trend in South Korea remained soft but stable, supported by steady supply but weighed down by weak demand.

China: Import Market Sentiment

In China, the Propylene Price Trend for imports from South Korea followed a similar pattern. CIF Shanghai prices reflected cautious procurement behavior by Chinese buyers. Industrial activity in China remained subdued, and downstream polymer demand was not strong enough to support higher prices.

Chinese buyers focused on managing inventories carefully and avoided overbuying. Imports were driven more by immediate production needs rather than speculative stocking. This selective buying approach limited price growth and kept the market well balanced.

North America: Stable with Localized Strength

In North America, the Propylene Price Trend was generally soft during Q3 2025 due to abundant supply and weaker export demand. Domestic markets were well supplied, and buyers did not face any shortage concerns.

However, toward the end of the quarter, some localized upward pressure appeared in Texas and the Gulf Coast regions. This was linked to regional demand patterns and logistical factors rather than a broader market recovery. Overall, the North American market remained stable but lacked strong momentum.

Conclusion: A Quarter of Balance and Caution

The Propylene Price Trend in Q3 2025 can best be described as balanced but cautious. Across major regions, supply was generally sufficient, feedstock availability remained stable, and freight conditions were manageable. However, weak downstream demand and conservative buying behavior prevented prices from moving higher.

While there were some regional differences, the overall global market shared similar themes: cautious sentiment, selective procurement, and limited price volatility. As the industry looks ahead, future price movements will largely depend on the recovery of downstream demand, changes in industrial activity, and any shifts in supply-side dynamics.

For now, Q3 2025 stands as a period where stability mattered more than growth, and where market participants focused on managing risk rather than chasing price increases.

About Price Watch™ AI

Price-Watch AI is an India-based, independent raw material price reporting agency that provides real-time price forecasts and data-driven insights into global raw material markets. Price-Watch AI specializes in tracking raw material prices, analyzing market trends, and delivering timely updates on plant shutdowns, supply disruptions, capacity expansions, and demand-supply dynamics. The Price-Watch AI platform empowers manufacturers, traders, and procurement professionals to make faster, smarter decisions. Leveraging AI-powered forecasting and over a decade of historical data, Price-Watch AI transforms market volatility into actionable opportunity.

Futura Tech Park,

C Block, 8th floor 334,

Old Mahabalipuram Road,

Sholinganallur, Chennai, Tamil Nadu, Pincode - 600119.

𝐋𝐢𝐧𝐤𝐞𝐝𝐈𝐧: https://www.linkedin.com/company/price-watch-ai/

𝐅𝐚𝐜𝐞𝐛𝐨𝐨𝐤: https://www.facebook.com/people//61568490385598/

𝐓𝐰𝐢𝐭𝐭𝐞𝐫: https://x.com/pricewatchai

𝐖𝐞𝐛𝐬𝐢𝐭𝐞: https://www.price-watch.ai/

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness