RBD Palm Oil Prices: Market Trends and Strategic Procurement Insights

RBD palm oil, which stands for Refined, Bleached, and Deodorized palm oil, is one of the most widely traded edible oils in the global market. It is used across food processing, bakery, confectionery, snacks, frying applications, and even in non-food industries. For manufacturers and procurement professionals, tracking RBD Palm Oil Prices is essential for cost planning and supply stability.

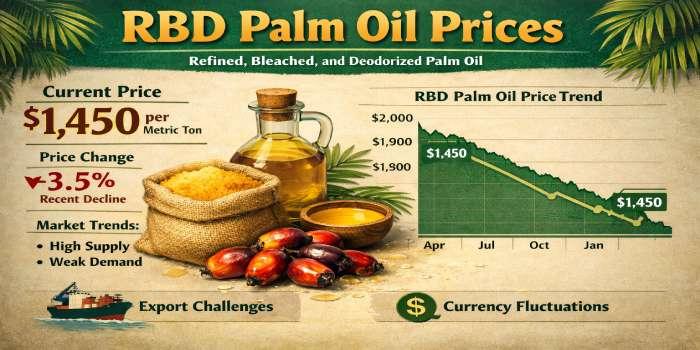

Since palm oil is a globally traded agricultural commodity, its price does not remain static. It responds to production cycles, export policies, weather conditions, and global vegetable oil demand. Therefore, staying informed about pricing trends allows businesses to plan purchases more efficiently and reduce unexpected cost pressures.

👉 👉 👉 Please Submit Your Query For RBD Palm Oil Prices, Forecast And Market Analysis: https://www.price-watch.ai/book-a-demo/

Understanding the RBD Palm Oil Market

RBD palm oil is derived from crude palm oil through a refining process that removes impurities, color, and odor. Because of its neutral taste and stable performance in cooking and food manufacturing, it has consistent demand throughout the year.

However, RBD Palm Oil Prices are influenced by more than just local supply and demand. International trade plays a central role. Major producing countries supply large volumes to importing regions, making the market sensitive to global economic and logistical changes.

For procurement teams, understanding this interconnected market structure is the first step toward effective sourcing.

Key Factors Influencing RBD Palm Oil Prices

Several important factors contribute to fluctuations in RBD Palm Oil Prices. Recognizing these drivers helps manufacturers and supply chain professionals make informed decisions.

Crude Palm Oil Production: Since RBD palm oil is processed from crude palm oil, production levels directly affect pricing. Crop yields depend on:

-

Weather conditions

-

Seasonal harvest cycles

-

Plantation productivity

-

Labor availability

When production is strong, supply improves and prices may stabilize. When yields fall, price pressure increases.

Global Edible Oil Demand: Palm oil competes with soybean oil, sunflower oil, and other vegetable oils. If prices of alternative oils rise, demand for palm oil may increase, supporting higher pricing levels. Similarly, if other oils become cheaper, substitution may impact demand.

Energy and Processing Costs: Refining palm oil requires energy, transportation, and industrial infrastructure. Rising fuel prices and electricity costs increase production expenses, which can reflect in final pricing.

Export Duties and Trade Policies: Government policies, including export taxes or quotas, significantly impact supply availability in global markets. Trade restrictions or policy changes in producing countries often cause short-term price volatility.

Freight and Logistics: Shipping rates, container availability, and port congestion influence landed costs. For importing countries, logistics can be a major component of total procurement expenses.

By monitoring these drivers, companies can better anticipate shifts in RBD Palm Oil Prices and reduce procurement risks.

Regional Market Variations

Although palm oil is globally traded, price movements can differ by region.

-

Southeast Asia: The primary production hub that sets global supply direction.

-

South Asia: Heavily dependent on imports, making freight and currency exchange important factors.

-

Middle East and Africa: Strong demand from food manufacturing and re-export markets.

-

Europe: Influenced by regulatory standards and sustainability requirements.

For multinational companies, regional awareness helps optimize sourcing decisions and manage cross-border risks.

Common Market Challenges

Despite stable demand, the RBD palm oil market faces several ongoing challenges:

-

Climate variability affecting harvest cycles

-

Geopolitical tensions influencing trade routes

-

Currency fluctuations impacting import costs

-

Sustainability regulations shaping supply chains

These elements can create short-term fluctuations, even when long-term demand remains steady.

Smart Procurement Strategies

Managing volatility in RBD Palm Oil Prices requires a structured procurement approach. Leading manufacturers and supply chain professionals often apply the following strategies:

-

Long-Term Contracts: Lock in pricing during favorable market conditions.

-

Supplier Diversification: Reduce reliance on a single region or exporter.

-

Regular Market Monitoring: Track crop reports, export announcements, and global oil trends.

-

Inventory Planning: Maintain balanced stock levels to handle temporary price spikes.

-

Cost Forecasting Models: Use historical trends and demand projections for better budgeting.

These practical steps improve resilience and support stable production planning.

Future Outlook

Looking ahead, the outlook for RBD Palm Oil Prices will depend on agricultural output, energy markets, and global economic recovery patterns. Demand from food processing industries is expected to remain strong, particularly in developing economies with growing populations.

At the same time, sustainability initiatives and environmental considerations may shape long-term supply structures. Companies that prioritize responsible sourcing and transparent supply chains may gain stronger partnerships and improved market positioning.

While short-term volatility is likely to continue, strategic planning and market intelligence can reduce uncertainty.

Conclusion

RBD palm oil remains a critical raw material for numerous industries worldwide. Because it is closely linked to agricultural production, trade policies, and global vegetable oil markets, price fluctuations are part of the business environment. Monitoring RBD Palm Oil Prices is not just about tracking numbers; it is about understanding the factors behind them. Stay ahead of changing RBD Palm Oil Prices with reliable market insights and timely data. Strengthen your procurement strategy, improve cost forecasting, and secure long-term supply stability. Make informed decisions today to protect your margins and enhance your competitive advantage.

About Price Watch™

Price Watch™ AI is an India-based, independent price reporting agency (PRA) that provides real-time price forecasts and data-driven insights into global raw material markets. It specializes in tracking prices, analyzing market trends, and delivering timely updates on plant shutdowns, supply disruptions, capacity expansions, and demand–supply dynamics. Price Watch™ AI reporting goes beyond prices to include grade-level insights, applications, and country-level demand intelligence you can trust. Powered by AI forecasting and over a decade of historical data, the Price Watch™ AI platform empowers manufacturers, traders, and procurement professionals to make faster, smarter decisions and turn market volatility into actionable opportunity.

Futura Tech Park,

C Block, 8th floor 334,

Old Mahabalipuram Road,

Sholinganallur, Chennai, Tamil Nadu, Pincode - 600119.

LinkedIn: https://www.linkedin.com/company/price-watch-ai/

Facebook: https://www.facebook.com/people/Price-Watch/61568490385598/

Twitter: https://x.com/pricewatchai

Website: https://www.price-watch.ai/

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spiele

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness