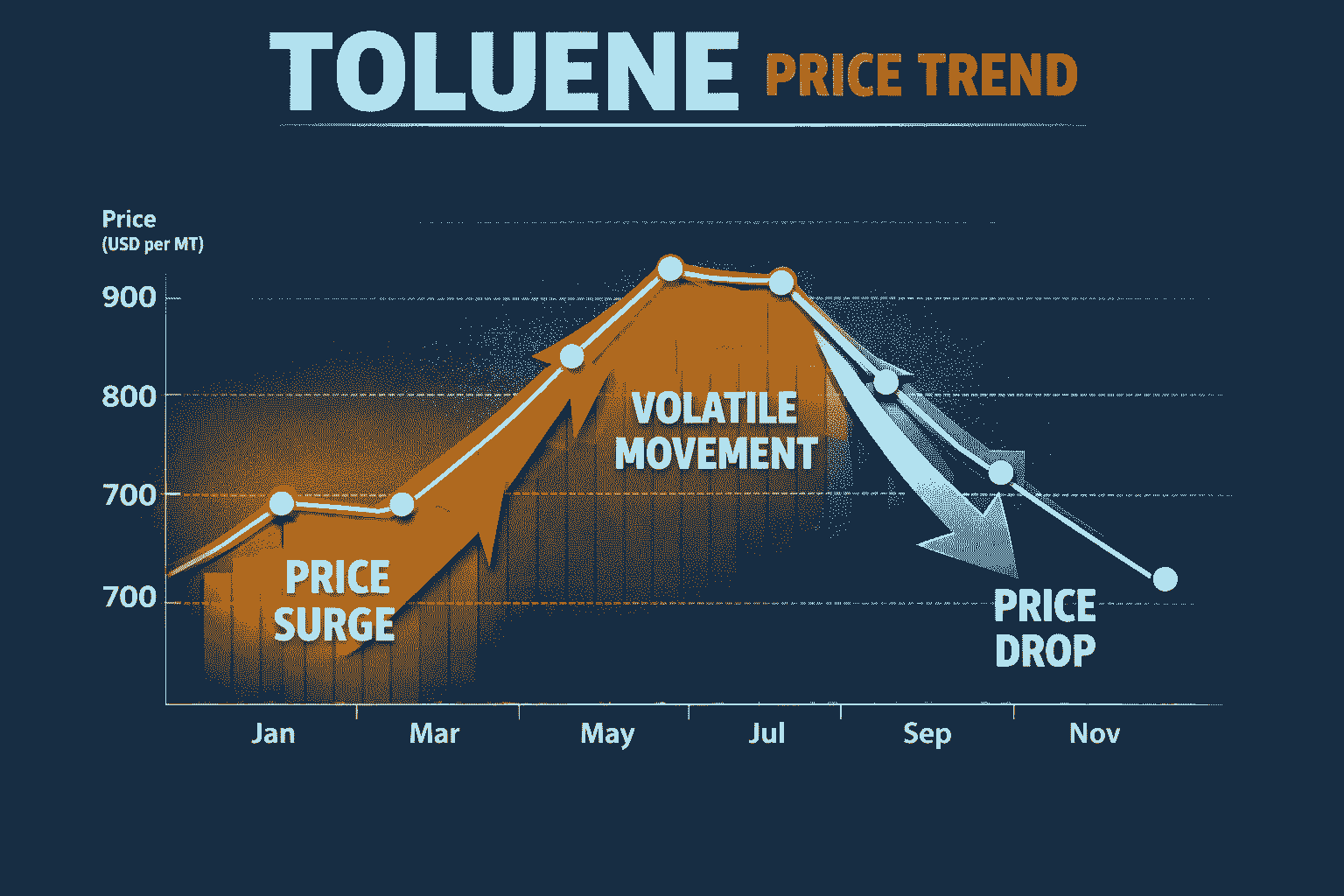

Toluene Price Trend: A Global Market Story in Q3 2025

The Toluene Price Trend during the third quarter of 2025 reflected a market that was balanced overall but clearly divided by region. While some parts of the world saw price support from steady demand and tighter supply, others faced softness due to oversupply, weaker industrial activity, or cautious buying behavior. These regional differences shaped how toluene prices moved across global markets and highlighted how local demand, feedstock costs, and supply chains continue to play a major role in pricing.

Toluene is a widely used aromatic solvent and chemical intermediate. It is commonly consumed in industries such as paints, coatings, adhesives, construction materials, automotive components, and chemical derivatives. Because of this wide usage, the Toluene Price Trend often closely follows the health of industrial activity and manufacturing demand in each region.

North America: Modest Strength in the West

In Western markets such as the United States and Canada, the Toluene Prices showed modest upward movement during Q3 2025. This firmness was mainly supported by healthy demand from downstream sectors like solvents, coatings, and adhesives. These industries continued to perform well due to ongoing construction activity and stable manufacturing output.

Another important factor supporting prices in North America was tight supply. Production availability remained somewhat limited, and suppliers were cautious about increasing output aggressively. At the same time, feedstock costs stayed firm, which prevented producers from offering lower prices. Together, these elements created a supportive environment for prices, even though demand growth was not exceptionally strong.

Please Submit Your Query For Toluene Price Trend, Market Analysis and Forecast: https://www.price-watch.ai/book-a-demo/

Overall, the North American toluene market during this period can be described as stable with mild bullish pressure. Buyers were active but careful, and sellers maintained pricing discipline.

Western Europe: Softer Demand, Weaker Prices

In contrast, Western European markets such as Germany, France, and the Netherlands experienced a slightly weaker Toluene Price Trend in Q3 2025. Prices edged down as industrial demand softened across several key sectors.

The automotive industry, construction activity, and chemical derivatives production all showed signs of slowdown. Many manufacturers reduced operating rates or delayed procurement due to uncertain economic conditions. This cautious approach reduced buying interest for toluene, putting pressure on prices.

Additionally, European buyers had sufficient inventories and did not feel urgency to restock. With supply remaining adequate and demand staying subdued, sellers had limited bargaining power. As a result, prices drifted lower rather than showing any strong recovery.

The European toluene market during this quarter reflected broader industrial challenges, where weaker end-use consumption directly impacted the Toluene Price Trend.

Asia-Pacific: Oversupply and Soft Consumption

Across the Asia-Pacific region, the Toluene Price Trend generally moved on the softer side. Countries such as China, Vietnam, Malaysia, and Thailand experienced mild price declines during Q3 2025.

One of the main reasons for this softness was market oversupply. Production levels remained steady, but consumption did not rise at the same pace. At the same time, imports from competing regions increased, adding pressure on local prices. Logistical challenges and competitive freight rates also contributed to intense competition among suppliers.

Many buyers in the region adopted a wait-and-watch approach. Instead of building inventories, they preferred short-term purchases, expecting prices to remain stable or soften further. This cautious buying behavior limited upward momentum in the Toluene Price Trend.

Despite this softness, the market did not collapse. Industrial activity continued at moderate levels, and feedstock availability remained stable, which helped keep prices within a controlled range.

India: Mild Firmness with Monthly Correction

In India, the Toluene Price Trend during Q3 2025 showed mild firmness overall, supported by steady demand from downstream industries such as paints, coatings, and solvents. These sectors continued to perform well due to consistent infrastructure development and manufacturing activity.

Domestically traded toluene prices on an ex-Kandla basis averaged between USD 720 and USD 790 per metric ton during the quarter. Buyers remained active, and procurement levels stayed healthy, reflecting confidence in ongoing industrial demand.

However, September 2025 saw a slight month-on-month correction, with prices declining by around 3.45%. This decrease did not signal weak fundamentals but rather a normal adjustment after earlier firmness. Feedstock costs such as reformate and crude oil moved only marginally, offering limited price direction.

Indian refiners and aromatics producers maintained stable supply, which helped prevent sharp price fluctuations. Overall, the Toluene Price Trend in India remained steady and balanced, supported by domestic consumption and controlled supply.

China: Cautious Market with Mixed Signals

China’s Toluene Price Trend in Q3 2025 leaned slightly bearish but showed signs of short-term improvement toward the end of the quarter. FOB Qingdao prices ranged between USD 690 and USD 740 per metric ton, marking a small quarterly decline of about 1.31%.

The price softness was mainly driven by weaker regional demand and strong competition from suppliers in the Middle East and Southeast Asia. Export interest remained limited, and buyers were selective in their purchases.

Downstream sectors such as benzene and xylene showed mixed performance, which affected overall demand for toluene. Meanwhile, feedstock naphtha costs edged lower, reducing cost support for producers.

Despite these challenges, September 2025 saw a month-on-month price increase of around 1.84%, suggesting slight improvement in short-term sentiment. This rise was supported by limited restocking and expectations of better demand ahead. Still, overall market sentiment remained cautious.

Singapore: Import Market Reflecting Regional Trends

Singapore, as a key trading and import hub, reflected broader Asian market conditions. The Toluene Price Trend in Singapore followed movements in Chinese export prices and regional supply dynamics.

Import prices remained under pressure due to ample availability and competitive offers from multiple suppliers. Buyers focused on near-term requirements and avoided large commitments. Stable freight conditions helped keep costs predictable, but demand did not show strong growth.

Overall Market Outlook

Globally, the Toluene Price Trend in Q3 2025 remained reasonably balanced despite regional disparities. While some markets benefited from steady demand and tighter supply, others faced pressure from oversupply and softer industrial activity.

Stable feedstock availability, moderate freight rates, and controlled production levels helped prevent extreme price swings. Regional supply chain fundamentals and downstream consumption patterns continued to be the most important factors influencing prices.

As the market moves forward, the direction of the Toluene Price Trend will likely depend on industrial recovery, demand from construction and automotive sectors, and movements in crude oil and naphtha prices. Buyers and sellers alike are expected to remain cautious, focusing on short-term needs while watching broader economic signals closely.

In summary, Q3 2025 showed that the toluene market is resilient but sensitive to regional conditions. Understanding these differences remains key to tracking and interpreting the Toluene Price Trend accurately.

About Price Watch™ AI

Price-Watch AI is an India-based, independent raw material price reporting agency that provides real-time price forecasts and data-driven insights into global raw material markets. Price-Watch AI specializes in tracking raw material prices, analyzing market trends, and delivering timely updates on plant shutdowns, supply disruptions, capacity expansions, and demand-supply dynamics. The Price-Watch AI platform empowers manufacturers, traders, and procurement professionals to make faster, smarter decisions. Leveraging AI-powered forecasting and over a decade of historical data, Price-Watch AI transforms market volatility into actionable opportunity.

Futura Tech Park,

C Block, 8th floor 334,

Old Mahabalipuram Road,

Sholinganallur, Chennai, Tamil Nadu, Pincode - 600119.

𝐋𝐢𝐧𝐤𝐞𝐝𝐈𝐧: https://www.linkedin.com/company/price-watch-ai/

𝐅𝐚𝐜𝐞𝐛𝐨𝐨𝐤: https://www.facebook.com/people//61568490385598/

𝐓𝐰𝐢𝐭𝐭𝐞𝐫: https://x.com/pricewatchai

𝐖𝐞𝐛𝐬𝐢𝐭𝐞: https://www.price-watch.ai/

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness