Is Vietnam’s Private Health Insurance Market Entering a High-Growth Era?

Key Drivers Impacting Executive Summary Vietnam Private Health Insurance Market Size and Share

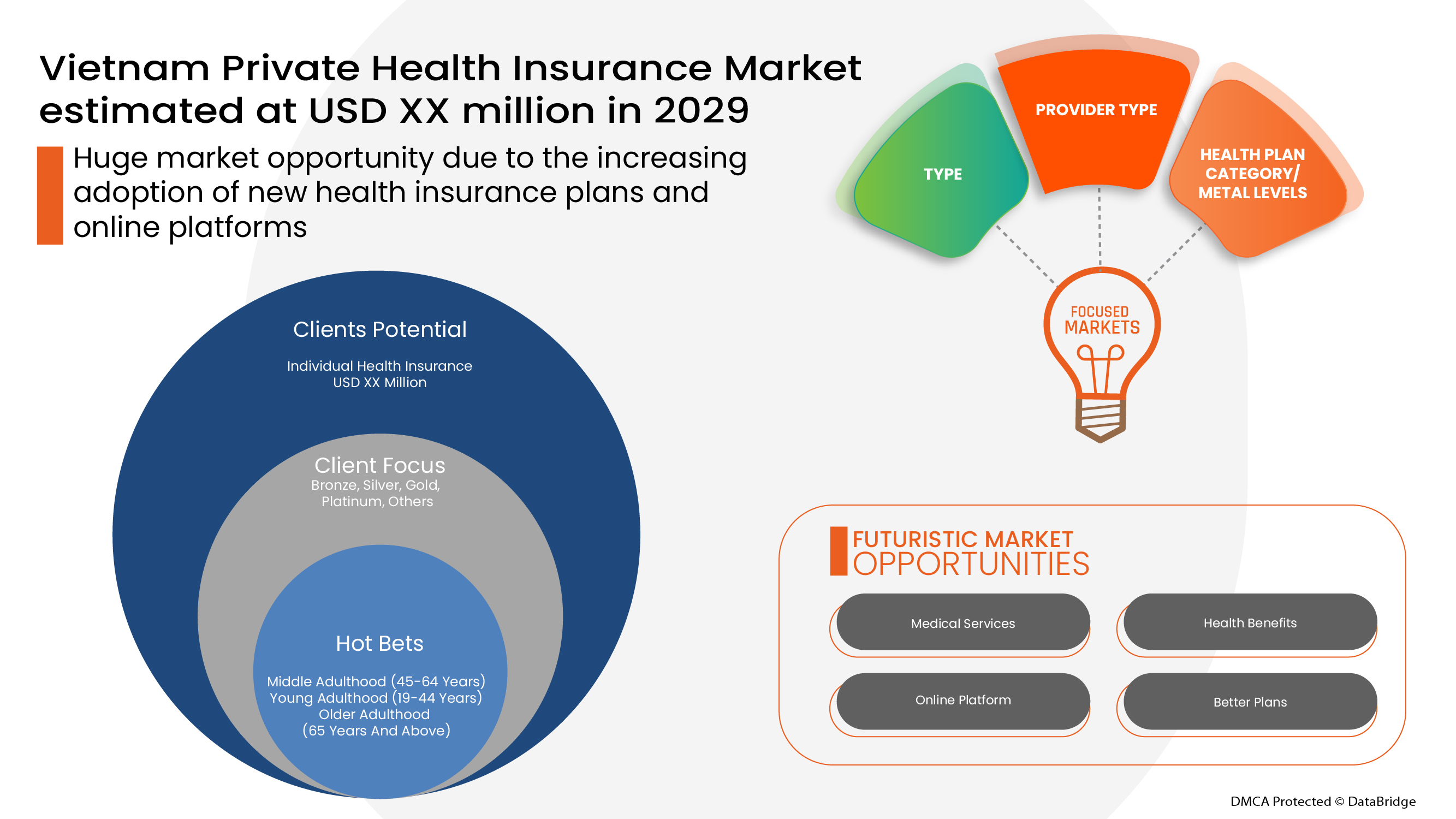

Data Bridge Market Research analyses that the Vietnam private health insurance market is expected to reach the value of USD 1,516.75 million by the year 2029, at a CAGR of 1.4% during the forecast period.

The report explains the vital developments about the Vietnam Private Health Insurance Market which range from the crucial improvements of the market, containing research and development, new item dispatch, pronouncement, coordinated efforts, associations, joint aspire, and territorial development of the key rivals working in the market on a global and local scale. Moreover, the report also estimates the vital market features that comprise revenue (USD), price (USD), capacity utilization rate, production, gross, production rate, consumption, import-export, supply-demand analysis, cost, market share, gross margin and market CAGR value. These and many other salient features make this Vietnam Private Health Insurance report outperform.

The report also identifies and analyzes the up-and-coming trends along with major drivers, challenges, and opportunities in the Vietnam Private Health Insurance Market industry. The market type, organization size, availability on-premises, end-users’ organization type, and the availability in areas such as North America, South America, Europe, Asia-Pacific, and the Middle East & Africa are kept at the center while building this global Vietnam Private Health Insurance Market report. A number of business challenges can be conquered with this market research report. The report has been provided with the comprehensive market insights and analysis that offer an advanced perspective of the marketplace.

Understand market developments, risks, and growth potential in our Vietnam Private Health Insurance Market study. Get the full report:

https://www.databridgemarketresearch.com/reports/vietnam-private-health-insurance-market

Vietnam Private Health Insurance Industry Trends

Segments

- Individual Health Insurance: This segment caters to individuals who seek health insurance coverage for themselves only. It may include coverage for hospitalization, outpatient services, and other medical expenses.

- Family Health Insurance: Family health insurance policies provide coverage for the entire family under a single plan. This segment is popular among families looking for comprehensive health coverage for all members.

- Group Health Insurance: Group health insurance is designed for companies or organizations to provide health coverage to their employees or members. It is a cost-effective way to ensure a group of people have access to medical services.

- Senior Health Insurance: This segment focuses on providing health insurance options specifically tailored to the needs of the elderly population. It may include coverage for age-related health issues and long-term care.

Market Players

- BaoViet Holdings: One of the leading insurance groups in Vietnam, BaoViet offers a range of health insurance products to cater to various segments of the market.

- Prudential Vietnam: As a prominent player in the Vietnamese insurance industry, Prudential offers comprehensive health insurance solutions to individuals and families.

- Manulife Vietnam: With a strong presence in the market, Manulife provides innovative health insurance products to meet the diverse needs of customers.

- Liberty Insurance Vietnam: Liberty Insurance offers a variety of health insurance plans, including individual and family coverage options, to meet the evolving healthcare needs of consumers.

- Dai-ichi Life Vietnam: Known for its reliable insurance services, Dai-ichi Life Vietnam provides customized health insurance solutions for different segments of the market.

The Vietnam private health insurance market is a dynamic sector that offers a wide range of insurance products tailored to meet the diverse needs of consumers. With the increasing focus on healthcare and wellness, the market has witnessed significant growth in recent years. The individual health insurance segment caters to those seeking personalized coverage, while family health insurance policies provide comprehensive options for households. Group health insurance remains popular among businesses looking to support their employees' well-being. Additionally, the senior health insurance segment addresses the specific healthcare needs of the elderly population. Leading market players such as BaoViet Holdings, Prudential Vietnam, Manulife Vietnam, Liberty Insurance Vietnam, and Dai-ichi Life Vietnam play a crucial role in driving innovation and competitiveness within the market.

DDDDDThe Vietnam private health insurance market is currently experiencing a transformation driven by evolving consumer needs and market dynamics. One notable trend is the increasing demand for customized health insurance solutions tailored to specific segments of the population. Insurers are recognizing the importance of offering personalized coverage options to cater to individuals, families, businesses, and the elderly. This trend is fueling competition among market players to innovate and develop products that meet the diverse healthcare needs of consumers in Vietnam.

Another key development in the market is the emphasis on digitalization and technology integration in health insurance services. Insurers are leveraging digital platforms to enhance customer experience, streamline processes, and offer innovative solutions such as telemedicine and health tracking apps. By embracing technology, market players can not only improve operational efficiency but also provide more accessible and convenient healthcare services to policyholders.

Furthermore, the growing awareness of the importance of health and wellness is influencing product offerings in the Vietnam private health insurance market. Insurers are expanding their coverage to include preventive care services, wellness programs, and lifestyle management initiatives to promote overall health and well-being. This shift towards a more holistic approach to healthcare insurance reflects the changing preferences and priorities of consumers in Vietnam.

Moreover, the regulatory environment and government initiatives are shaping the landscape of the private health insurance market in Vietnam. Regulatory reforms aimed at increasing transparency, consumer protection, and market stability are influencing how insurers design and market their products. Government initiatives to promote universal health coverage and expand access to healthcare services are also driving collaboration between public and private sector stakeholders in the health insurance industry.

In conclusion, the Vietnam private health insurance market is undergoing significant changes driven by shifting consumer expectations, advances in technology, a focus on health and wellness, and regulatory developments. As insurers continue to adapt to these trends and challenges, the market is expected to witness further growth and innovation in the coming years. Collaborations, strategic partnerships, and investments in digital capabilities will be essential for market players to stay competitive and meet the evolving needs of consumers in Vietnam.The Vietnam private health insurance market has been experiencing notable transformations driven by various factors that are reshaping the industry landscape. One significant trend observed is the increasing demand for personalized health insurance solutions tailored to different segments of the population. This indicates a shift towards a more customer-centric approach in the market, with insurers recognizing the importance of offering tailored products to meet the specific needs of individuals, families, businesses, and seniors. This trend not only enhances customer satisfaction but also fosters competition among market players to develop innovative and targeted insurance products.

Moreover, the integration of digital technologies in health insurance services has become a prominent development within the market. Insurers are leveraging digital platforms to enhance the overall customer experience, streamline processes, and introduce innovative solutions like telemedicine and health tracking applications. By incorporating technology into their operations, insurers can improve efficiency, accessibility, and convenience for policyholders, aligning with the evolving technological landscape and consumer preferences.

Furthermore, the growing emphasis on health and wellness in the Vietnam private health insurance market is influencing product offerings and service offerings. Insurers are expanding coverage to include preventive care services, wellness programs, and lifestyle management initiatives to promote overall health and well-being among policyholders. This shift towards a more holistic approach to healthcare insurance underscores the changing consumer preferences towards proactive health management and the importance of prevention alongside treatment.

Additionally, regulatory reforms and government initiatives are playing a significant role in shaping the private health insurance market in Vietnam. Regulatory changes aimed at enhancing transparency, consumer protection, and market stability are influencing insurers' product development and marketing strategies. Government efforts to promote universal health coverage and improve access to healthcare services are fostering collaboration between public and private sector entities within the health insurance industry, paving the way for a more integrated and inclusive healthcare ecosystem.

In conclusion, the Vietnam private health insurance market is evolving rapidly, driven by consumer-centric trends, technological advancements, a focus on health and wellness, and regulatory developments. Insurers that adapt to these changing dynamics by offering personalized solutions, embracing digital innovation, catering to holistic healthcare needs, and aligning with regulatory requirements are likely to thrive in this dynamic market environment. Continued collaboration, strategic partnerships, and investments in digital capabilities will be vital for insurers to remain competitive and meet the evolving demands of consumers in Vietnam.

Break down the firm’s market footprint

https://www.databridgemarketresearch.com/reports/vietnam-private-health-insurance-market/companies

Vietnam Private Health Insurance Market Reporting Toolkit: Custom Question Bunches

- What is the total valuation of the Vietnam Private Health Insurance industry this year?

- What will be the future growth outlook of the Vietnam Private Health Insurance Market?

- What are the foundational segments discussed in the Vietnam Private Health Insurance Market report?

- Who are the dominant players in Vietnam Private Health Insurance Market each region?

- What countries are highlighted in terms of revenue growth for Vietnam Private Health Insurance Market?

- What company profiles are included in the Vietnam Private Health Insurance Market report?

Browse More Reports:

North America Popping Boba Juice Balls Market

Europe Loyalty Management Market

Middle East and Africa Health and Wellness Food Market

North America Health and Wellness Food Market

North America Food Storage Container Market

Europe Dental Implant Market

Asia-Pacific Dental Implants Market

Asia-Pacific Dairy Alternative Market

Asia-Pacific Cosmetics Market

Middle East and Africa Colorectal Cancer Diagnostics Market

Europe C-Arms Market

Asia Pacific Biochar Market

North America Biochar Market

Global Camel Dairy Market

Global Naphtha Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness