-

Feed de notícias

- EXPLORAR

-

Páginas

-

Grupos

-

Eventos

-

Blogs

-

Marketplace

-

Fóruns

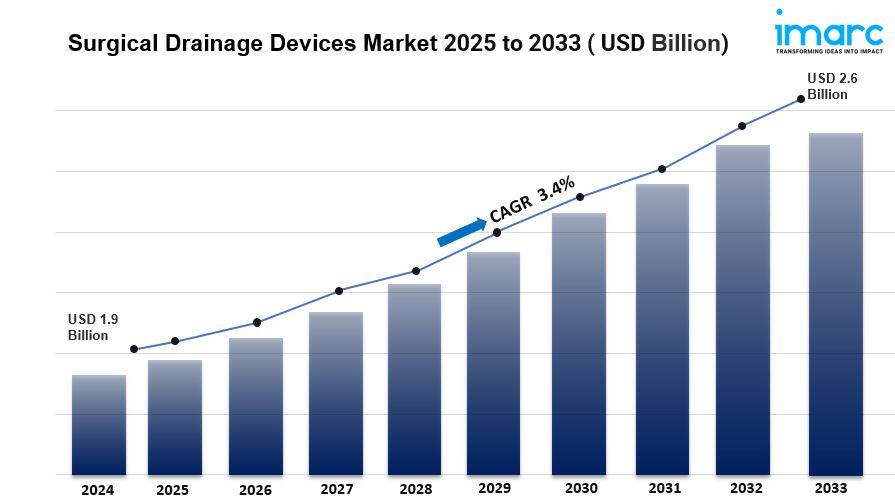

Surgical Drainage Devices Market Size to Cross USD 2.56 Billion by 2033 |CAGR 3.4%

Surgical Drainage Devices Market Overview

The global Surgical Drainage Devices Market was valued at USD 1.90 Billion in 2024 and is projected to reach USD 2.56 Billion by 2033. The market is expected to grow at a CAGR of 3.4% during the forecast period 2025-2033. North America leads the market with a share exceeding 43.3% in 2024, driven by growing number of procedures related to chest, breast, abdominal, lymph node, and thyroid surgeries.

The Surgical Drainage Devices Market Trends are evolving rapidly due to increasing incidence of chronic diseases and a higher volume of surgeries being performed globally. Manufacturers are emphasizing minimally invasive devices, advanced suction mechanisms, enhanced sterility, and smart drainage systems with automated monitoring capabilities. The market is also driven by technological advancements in drainage systems including portable devices, digital chest drainage systems, and biodegradable materials. In addition, rising adoption of active drainage systems, improved post-operative care protocols, and innovations in reducing complications such as infections and fluid retention are shaping future Surgical Drainage Devices Market Trends, offering new opportunities for manufacturers and healthcare providers globally.

Request Customization: https://www.imarcgroup.com/request?type=report&id=4134&flag=E

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

Surgical Drainage Devices Market Key Takeaways

- Current Market Size: USD 1.90 Billion (2024)

- CAGR: 3.4% (2025-2033)

- Forecast Period: 2025-2033

- North America holds the largest market share of over 43.3% in 2024.

- Active drainage systems dominate with nearly 79.8% market share due to superior fluid management and complication prevention.

- Cardio-thoracic surgeries represent the largest application segment at 26.7% driven by high procedure volumes and critical drainage requirements.

- Hospitals dominate end-use segment with 47.9% market share in 2024 due to high surgical volumes and advanced care facilities.

- Advancements in minimally invasive procedures and digital drainage systems enhance patient outcomes and reduce recovery times.

- Rising elderly population and prevalence of chronic diseases increase demand for surgical interventions requiring drainage devices.

Request to Get the Sample Report: https://www.imarcgroup.com/surgical-drainage-devices-market/requestsample

Market Growth Factors

The primary driving factors for the surgical drainage devices market are the increasing incidence of chronic diseases and the growing global volume of surgical procedures. According to the World Health Organization, the population aged 60 and older is expected to double by 2050, resulting in higher prevalence of age-related health issues such as cardiovascular diseases, neurological disorders, and cancer. With approximately 310 million surgical procedures performed annually worldwide, the demand for effective post-operative drainage solutions continues to rise. The aging population faces increased surgical intervention needs, making drainage devices essential for preventing complications like fluid accumulation, infections, and post-surgical complications. In 2024, the market was valued at USD 1.90 Billion, and is expected to continue growing as healthcare infrastructure improves globally and surgical volumes increase.

Technological advancements in drainage systems are revolutionizing post-operative care and driving market expansion. Modern surgical drainage devices feature innovative designs with enhanced suction mechanisms, improved sterility, and reduced risk of complications. The development of minimally invasive drainage systems has transformed surgical procedures by reducing patient trauma, shortening recovery times, and minimizing infection risks. Digital chest drainage systems, such as the Thopaz+ by Medela, represent significant innovations in cardiothoracic surgery with automated monitoring capabilities that optimize fluid management. Active drainage systems, which comprise nearly 79.8% of the market, offer superior performance in managing post-operative fluid accumulation compared to passive devices. The evolution includes portable and automated drainage systems providing greater convenience for healthcare providers and patients, smart drainage devices with moisture sensors, and biodegradable materials such as biodegradable ureteral stents developed through collaborations like IIT Roorkee and UnivLabs Technologies.

The expansion of healthcare infrastructure and increasing surgical procedure volumes in emerging markets significantly contribute to market growth. Countries in Asia Pacific, Latin America, and the Middle East are experiencing substantial healthcare investment and infrastructure development. China invested USD 4.9 trillion in healthcare in 2023, while India allocated USD 10.9 billion for healthcare spending in 2024-25, both reflecting commitment to expanding medical capabilities. The growth of medical tourism in regions offering affordable surgical procedures creates additional demand for advanced drainage solutions. Regional partnerships between domestic manufacturers and international organizations facilitate the development of locally relevant drainage equipment tailored to specific healthcare requirements. Government initiatives such as China's "Healthy China 2030" program improve accessibility to advanced surgical technologies. Additionally, approximately 40 to 50 million surgical procedures take place annually in the United States alone, fueling continuous demand for effective drainage systems and driving innovation in minimally invasive devices.

Surgical Drainage Devices Market Segmentation

IMARC Group provides an analysis of the key trends in each segment of the global surgical drainage devices market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, application, and end use.

Product Insights:

- Active

- Passive

The active segment dominates with nearly 79.8% market share in 2024. Active drainage systems are more effective in managing post-operative fluid accumulation and minimizing complications like infections through precise suction mechanisms that enable controlled fluid removal.

Application Insights:

- Cardio-Thoracic Surgeries

- Neurosurgery Procedures

- Abdominal Surgery

- Orthopedics

- Others

Cardio-thoracic surgeries represent approximately 26.7% of the market in 2024, driven by high prevalence of cardiovascular and thoracic conditions requiring surgical interventions such as coronary artery bypass grafting, heart valve replacement, and lung resections.

End Use Insights:

- Hospitals

- Clinics

- Ambulatory Surgical Centers

Hospitals dominate with approximately 47.9% market share in 2024, driven by high surgical volumes ranging from general surgeries to specialized cardio-thoracic and orthopedic interventions, along with access to advanced medical equipment and comprehensive post-operative care services.

Regional Insights:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

North America dominates the global market with over 43.3% share in 2024, attributed to advanced healthcare infrastructure, high surgical procedure volumes, substantial healthcare spending, and the presence of leading market players including Medtronic, Johnson & Johnson, and Stryker Corporation.

Competitive Landscape

The global surgical drainage devices market is highly competitive with several leading companies including Acelity L.P. Inc. (3M Company), B. Braun Melsungen AG, Becton Dickinson and Company, Cardinal Health Inc., Cook Group Incorporated, Johnson & Johnson, Medela AG, Medtronic plc, Smith & Nephew plc, Stryker Corporation, and Teleflex Incorporated. These companies focus on innovation, extensive R&D investments, strategic mergers and acquisitions, and expanding regional presence to strengthen market positions.

Latest News and Developments

- June 2024: B. Braun Interventional Systems introduced the ACCEL All-Purpose and Biliary Drainage Catheters, featuring TrueGlide Hydrophilic Coating designed to promote patient comfort by improving fluid drainage and smooth percutaneous insertion.

- May 2024: The Thopaz+ digital chest drainage system by Medela highlighted ongoing improvements in cardiothoracic surgery, where digital systems have transformed post-operative management with automated monitoring capabilities.

- April 2024: IIT Roorkee partnered with UnivLabs Technologies to develop biodegradable ureteral stents for urology, aiming to reduce complications like infections and eliminate the need for follow-up surgeries.

- February 2024: FUJIFILM India launched the ALOKA ARIETTA 850, a cutting-edge endoscopic ultrasound system at Fortis Hospital, Bengaluru, advancing minimally invasive procedures like bile duct drainage and pseudocyst management.

Ask An Analyst: https://www.imarcgroup.com/request?type=report&id=4134&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness