Global Phthalic Anhydride Price Trend Report: Long-Term Historical Data, Key Industry Drivers, Economic Impacts, and Projections for the Next Decade

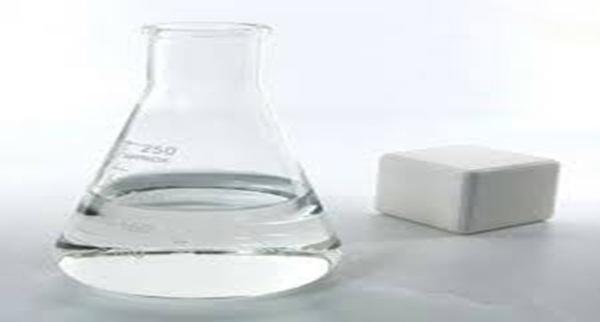

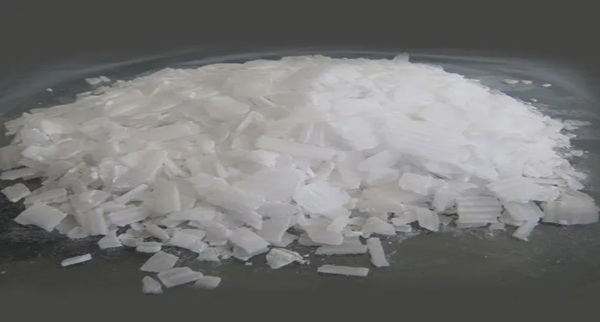

Phthalic anhydride is a widely used industrial chemical that plays an important role in everyday products, even though most people never hear its name. It is mainly used in the production of plasticizers, resins, paints, coatings, and some pharmaceuticals. Because of its close connection to construction, automotive, and consumer goods industries, the phthalic anhydride price trend often reflects broader movements in the economy. Over time, prices tend to move in response to demand patterns, raw material costs, energy prices, and overall market sentiment.

In simple terms, when industries that depend on plastics and coatings are active, demand for phthalic anhydride rises, and prices usually follow. When economic activity slows down, prices often soften. This natural push and pull makes the price trend an interesting indicator of industrial health.

Please Submit Your Query for Phthalic Anhydride Price Trend, demand-supply, suppliers, market analysis:

https://www.price-watch.ai/book-a-demo/

Key Factors Influencing Phthalic Anhydride Prices

One of the most important factors affecting the phthalic anhydride price trend is the cost of raw materials. Phthalic anhydride is primarily produced from ortho-xylene or naphthalene, both of which are derived from crude oil or coal processing. When crude oil prices rise, the cost of producing these feedstocks increases, which often leads to higher phthalic anhydride prices. On the other hand, when oil prices fall or remain stable, manufacturers may experience some relief in production costs.

Energy prices also play a significant role. The manufacturing process requires heat and electricity, so changes in fuel and power costs directly impact overall production expenses. In regions where energy prices are volatile, phthalic anhydride prices can fluctuate more frequently. This is especially noticeable during periods of global energy shortages or sudden fuel price spikes.

Demand from end-use industries is another major driver. Construction activity, for example, strongly influences demand because phthalic anhydride is used in PVC products, flooring, and coatings. When construction projects increase, especially in developing economies, demand rises and prices often strengthen. Conversely, during periods of slower construction or reduced industrial output, prices may face downward pressure.

Regional and Seasonal Market Behavior

The phthalic anhydride price trend can vary from one region to another. In areas with strong manufacturing bases and steady infrastructure development, demand tends to remain consistent. This often leads to relatively stable pricing, with gradual increases over time. In contrast, regions that rely heavily on imports may see sharper price movements due to logistics costs, currency fluctuations, and supply chain disruptions.

Seasonal patterns also influence prices. For example, construction activity usually slows during extreme weather conditions, such as harsh winters or heavy monsoon seasons. During these periods, demand for related products may dip slightly, which can affect phthalic anhydride prices. When activity resumes in more favorable seasons, demand often picks up again, supporting price recovery.

Supply-side factors cannot be ignored either. Planned maintenance shutdowns, unexpected plant outages, or environmental regulations can temporarily reduce supply. When supply tightens while demand remains steady, prices tend to rise. On the other hand, when new production capacity comes online, the market may experience temporary oversupply, leading to softer prices.

Please Submit Your Query for Phthalic Anhydride Price Trend, demand-supply, suppliers, market analysis:

https://www.price-watch.ai/book-a-demo/

About Price Watch™ AI

Price-Watch AI is an India-based, independent raw material price reporting agency that provides real-time price forecasts and data-driven insights into global raw material markets. Price-Watch AI specializes in tracking raw material prices, analyzing market trends, and delivering timely updates on plant shutdowns, supply disruptions, capacity expansions, and demand-supply dynamics. The Price-Watch AI platform empowers manufacturers, traders, and procurement professionals to make faster, smarter decisions. Leveraging AI-powered forecasting and over a decade of historical data, Price-Watch AI transforms market volatility into actionable opportunity.

Futura Tech Park,

C Block, 8th floor 334,

Old Mahabalipuram Road,

Sholinganallur, Chennai,

Tamil Nadu, Pincode - 600119.

LinkedIn:

https://www.linkedin.com/company/price-watch-ai/

Facebook:

https://www.facebook.com/people/Price-Watch/61568490385598/

Twitter:

https://x.com/pricewatchai

Website:

https://www.price-watch.ai/Global Phthalic Anhydride Price Trend Report: Long-Term Historical Data, Key Industry Drivers, Economic Impacts, and Projections for the Next Decade

Phthalic anhydride is a widely used industrial chemical that plays an important role in everyday products, even though most people never hear its name. It is mainly used in the production of plasticizers, resins, paints, coatings, and some pharmaceuticals. Because of its close connection to construction, automotive, and consumer goods industries, the phthalic anhydride price trend often reflects broader movements in the economy. Over time, prices tend to move in response to demand patterns, raw material costs, energy prices, and overall market sentiment.

In simple terms, when industries that depend on plastics and coatings are active, demand for phthalic anhydride rises, and prices usually follow. When economic activity slows down, prices often soften. This natural push and pull makes the price trend an interesting indicator of industrial health.

👉 👉 👉 Please Submit Your Query for Phthalic Anhydride Price Trend, demand-supply, suppliers, market analysis:https://www.price-watch.ai/book-a-demo/

Key Factors Influencing Phthalic Anhydride Prices

One of the most important factors affecting the phthalic anhydride price trend is the cost of raw materials. Phthalic anhydride is primarily produced from ortho-xylene or naphthalene, both of which are derived from crude oil or coal processing. When crude oil prices rise, the cost of producing these feedstocks increases, which often leads to higher phthalic anhydride prices. On the other hand, when oil prices fall or remain stable, manufacturers may experience some relief in production costs.

Energy prices also play a significant role. The manufacturing process requires heat and electricity, so changes in fuel and power costs directly impact overall production expenses. In regions where energy prices are volatile, phthalic anhydride prices can fluctuate more frequently. This is especially noticeable during periods of global energy shortages or sudden fuel price spikes.

Demand from end-use industries is another major driver. Construction activity, for example, strongly influences demand because phthalic anhydride is used in PVC products, flooring, and coatings. When construction projects increase, especially in developing economies, demand rises and prices often strengthen. Conversely, during periods of slower construction or reduced industrial output, prices may face downward pressure.

Regional and Seasonal Market Behavior

The phthalic anhydride price trend can vary from one region to another. In areas with strong manufacturing bases and steady infrastructure development, demand tends to remain consistent. This often leads to relatively stable pricing, with gradual increases over time. In contrast, regions that rely heavily on imports may see sharper price movements due to logistics costs, currency fluctuations, and supply chain disruptions.

Seasonal patterns also influence prices. For example, construction activity usually slows during extreme weather conditions, such as harsh winters or heavy monsoon seasons. During these periods, demand for related products may dip slightly, which can affect phthalic anhydride prices. When activity resumes in more favorable seasons, demand often picks up again, supporting price recovery.

Supply-side factors cannot be ignored either. Planned maintenance shutdowns, unexpected plant outages, or environmental regulations can temporarily reduce supply. When supply tightens while demand remains steady, prices tend to rise. On the other hand, when new production capacity comes online, the market may experience temporary oversupply, leading to softer prices.

👉 👉 👉 Please Submit Your Query for Phthalic Anhydride Price Trend, demand-supply, suppliers, market analysis:https://www.price-watch.ai/book-a-demo/

About Price Watch™ AI

Price-Watch AI is an India-based, independent raw material price reporting agency that provides real-time price forecasts and data-driven insights into global raw material markets. Price-Watch AI specializes in tracking raw material prices, analyzing market trends, and delivering timely updates on plant shutdowns, supply disruptions, capacity expansions, and demand-supply dynamics. The Price-Watch AI platform empowers manufacturers, traders, and procurement professionals to make faster, smarter decisions. Leveraging AI-powered forecasting and over a decade of historical data, Price-Watch AI transforms market volatility into actionable opportunity.

Futura Tech Park,

C Block, 8th floor 334,

Old Mahabalipuram Road,

Sholinganallur, Chennai,

Tamil Nadu, Pincode - 600119.

LinkedIn: https://www.linkedin.com/company/price-watch-ai/

Facebook: https://www.facebook.com/people/Price-Watch/61568490385598/

Twitter: https://x.com/pricewatchai

Website: https://www.price-watch.ai/